Gold has broken out to the upside, leaving many scratching their heads as to why. We see multiple potential causes, all of which are also acting as warning signals about the prospects for the US Bond Markets, Inflation and ultimately the currency, highlighting the importance of diversification in portfolios.

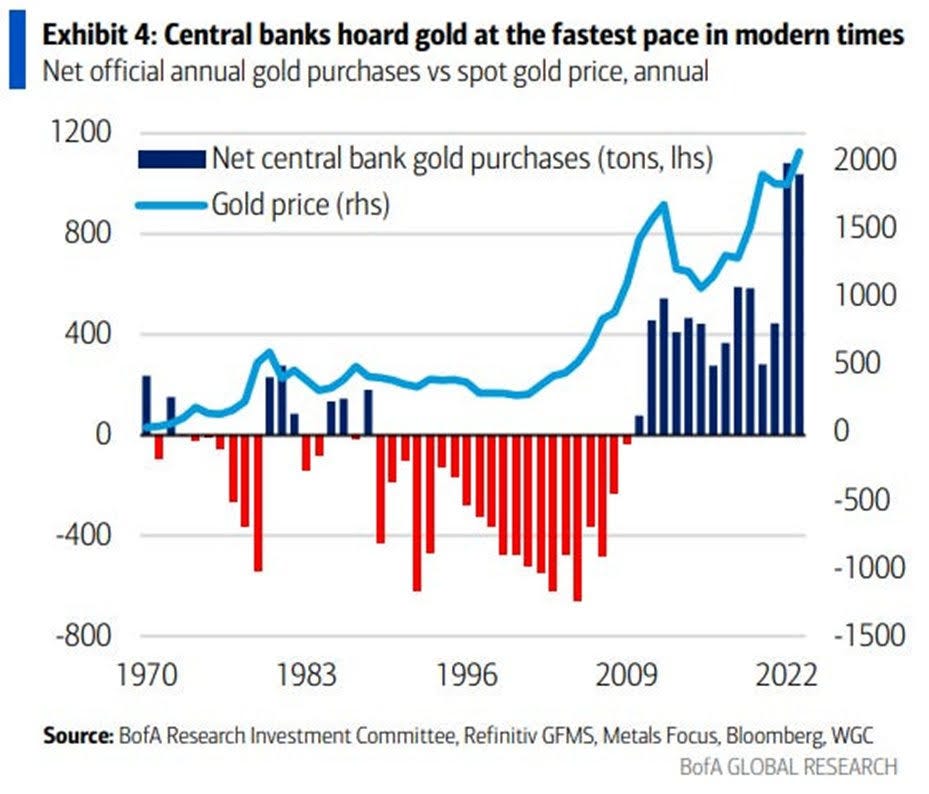

As discussed previously, Gold, having been one of the lagging strategies we follow during February, spiked higher in March, confounding most observers and begging answers as to why. One, eminently sensible, observation from our good friends at Redburn is that Central Banks have increasingly been hoarding gold, as we see in the chart below.

Source Redburn Atlantic

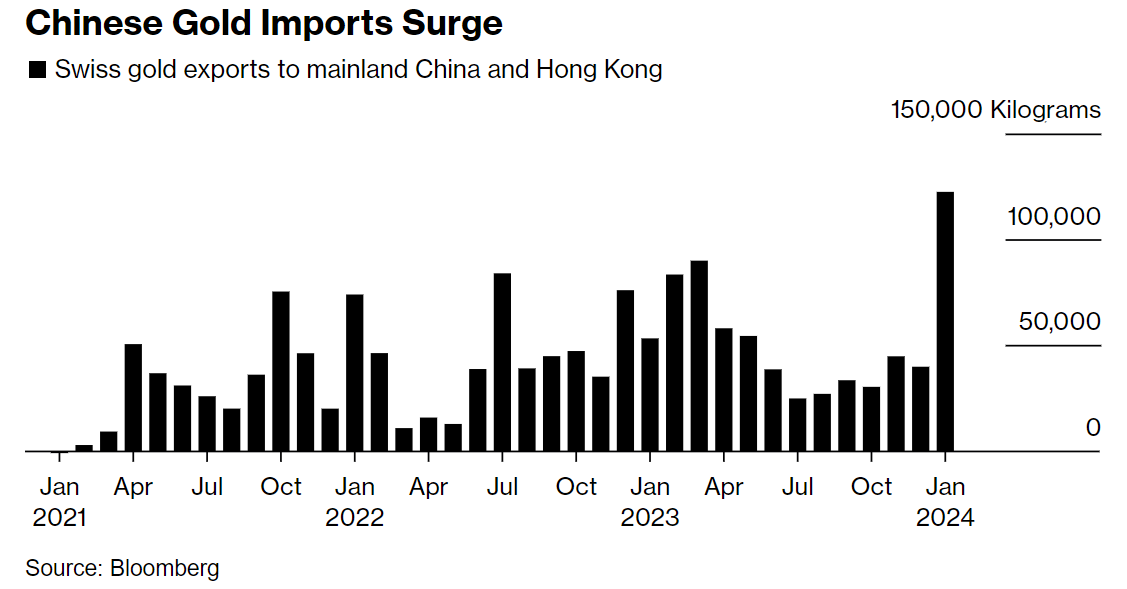

Certainly we wouldn’t dismiss this and see this as a trend, but it doesn’t really explain the sudden breakout in March, Central Banks don’t act in ways to spike markets (except for Gordon Brown obviously). A second aspect, with a chart also from Redburn, is that Chinese imports of physical gold have also been jumping, likely as part of a long term plan to diversify away from reliance on the US$ in their reserves.

Source Redburn Atlantic

This is also part of a longer term trend. We do not have similar data for Russia, or indeed the Middle East, but the reality is that Asia (especially if we take the ‘new’ definition of the Middle East as ‘West Asia’) is culturally biased towards physical Gold and now, in the wake of the ‘freezing’ of Russia’s FX reserves, is less inclined to hold US$ than it used to be. Moreover, as far as China is concerned, the Shanghai Gold exchange is now part of its Rmb trading mechanism; China is increasingly trading with ‘West Asia’ and the BRICS in Rmb, but offers a backstop of Gold via the Shanghai Exchange. Higher trading volumes means a need for higher holdings of Gold to act as Money, in its definition of ‘a medium of exchange’ and echoing the words of JP Morgan.

Gold is Money, everything else is Credit

J P Morgan 1912

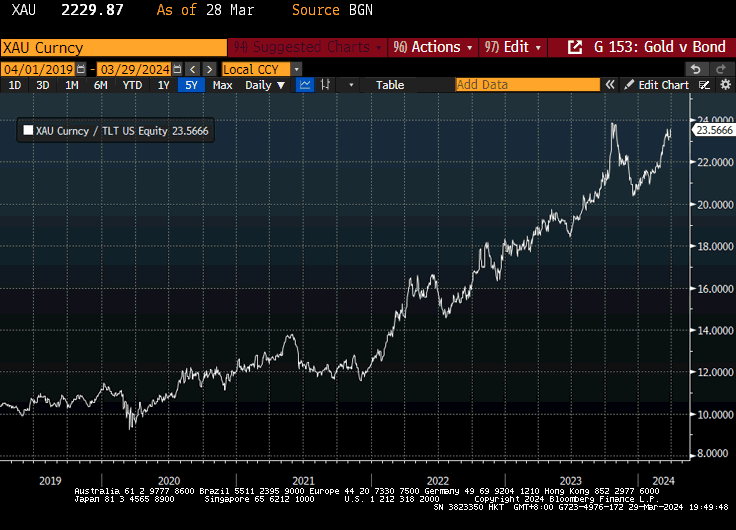

This of course touches on a further issue potentially behind renewed demand for gold; the uncertainty about Credit. The catastrophists out there continue to talk about the collapse of the US Bond market under a weight of oversupply and inflation, and in that sense they are (correctly) avoiding the notion of US Treasuries as a ‘Risk Free Rate of Return’, indeed, as previously discussed, bonds are acting as risk on rather than risk off assets, leaving the door open to cash, and potentially Gold, to assume that role. As such anything that adds to either of these conditions of oversupply and inflation is likely to trigger a move Bond and into cash and Gold.

The chart shows the ratio of Gold to TLT (the long bond ETF) over the last five years, with the sharp rally in bonds in Q4 being followed by a renewed spike in Gold, especially over the last month. Clearly Gold(finger) expects Mr Bond to die.

Gold (finger) winning against Bond

The catalyst. Fears of QE via the back door?

Of course in many senses this is a Bond problem rather than necessarily a positive for Gold - or indeed almost every other asset which shows a similar chart. However, to return to our question of ‘why now?’, analyst and renowned $ bear Luke Gromen pointed out recently that one factor in the spike in Gold generally, but also against TLT may be the request in early March by ISDA (essentially US Banks) to the Fed, the FDIC and the OCC for a permanent exemption to the Supplementary Leverage Ratio rules for holdings of US Treasuries. If this is agreed, then essentially we have QE again, only via the banks running an unlimited Net Interest Margin structure out of deposits and into US Treasuries. While this may put a floor under bond yields and facilitate the runaway Federal Budget, it will likely be inflationary and bad for the $ - hence the flight to Gold as the new risk off Asset.

Meanwhile, we wonder therefore if it might also be down to our old friend Bitcoin, which also had a (further) breakout in March, as shown in the chart. Firstly was it worrying about the same thing? And secondly, are we seeing Gold and Bitcoin now working together?

Are Gold and Digital Gold moving together?

The interesting thing to us is the white line, which is a small ETF called BOLD, which is essentially 75% Gold, 25% Bitcoin and while (as always) we need to be very careful of the scales used here, we wonder if this highlights not only a ‘new’ strategy, but a way in which Bitcoin - which some refer to as Digital Gold - and real Gold (both physical and on exchange) might be becoming linked? Perhaps, Bitcoin investors, including those switching out of the Grayscale Trust into the new ETFs, are diversifying their ‘profits’ and putting some of it into Gold? A case of Fool me once, on you, Fool me twice, on me.

This is certainly plausible, after all, a large part of the Bitcoin community are believers in a collapsing US $ - something that the latest Budget Bill won’t have given any comfort on - and in diversifying out of Bitcoin (to avoid repeating previous mistakes of over-concentration) Gold would seem the most obvious choice.

With the normal Caveat that this is not investment advice (please do your own research and contact your financial advisor before investing), we do wonder if this might not be a bad strategy for those in Gold as well - ie diversify into Bitcoin. The ETF is very small at the moment, but we can see it growing.

Canary in the Gold Mine?

To conclude, at its simplest the spike in Gold reflects a short term excess of supply over demand. However, the fact that this is coming from a number of sources - two of which, Central Bank accumulation and Chinese buying of physical gold, are connected with a broader de-dollarisation play should alert us to the medium term risks around the $ and the need for diversification. Meanwhile, the correlation with Bitcoin and the broader macro traders concerns about the ‘risk free’ nature of US Treasuries should alert us to the ongoing problems with the US deficit and the likely inflationary consequences of returning to some form of QE - most likely via a (lucrative for them) deal with the Banks. The fact that a weaker $ would also play into facilitating this also closes this second loop on the diversification theme, with Gold seen as a winner in a weaker $ scenario. Finally, the suggestion of an interaction between Gold and Bitcoin suggest that these two ‘non $’ assets may become a variation on the 60:40 portfolio, with Bitcoin as the risk on Asset being blended with the more liquid and ‘stable’ gold as the risk off asset. The new BOLD ETF is well named, but may well be pointing the way.