A mistake or a Forecast?

AI hallucinating about AI....but not obscuring an important signal about China and AI

The recent Moore Threads IPO is significant on multiple levels. Economically, it highlights how sanctions on China have backfired and that companies like Moore Threads, sometimes referred to as China’s Nvidia, are actually symptomatic of something bigger; thanks to being denied access to the latest chips, China has developed its own AI infrastructure and basically doesn’t need Nvidia.

At the market level, it is the latest IPO in the sector that has seen huge jumps on debut and even though it was only raising $1bn, the fact that the issue was wildly oversubscribed highlights that there is literally trillions of $ in Chinese retail money looking to invest.

Of course a lot of this cash is hoping to ‘flip’, but the result is that China is now offering an increasingly diverse set of opportunities for longer term investors to play Chinese Tech growth.

I talked about this on CNBC yesterday (link for part of the interview here)

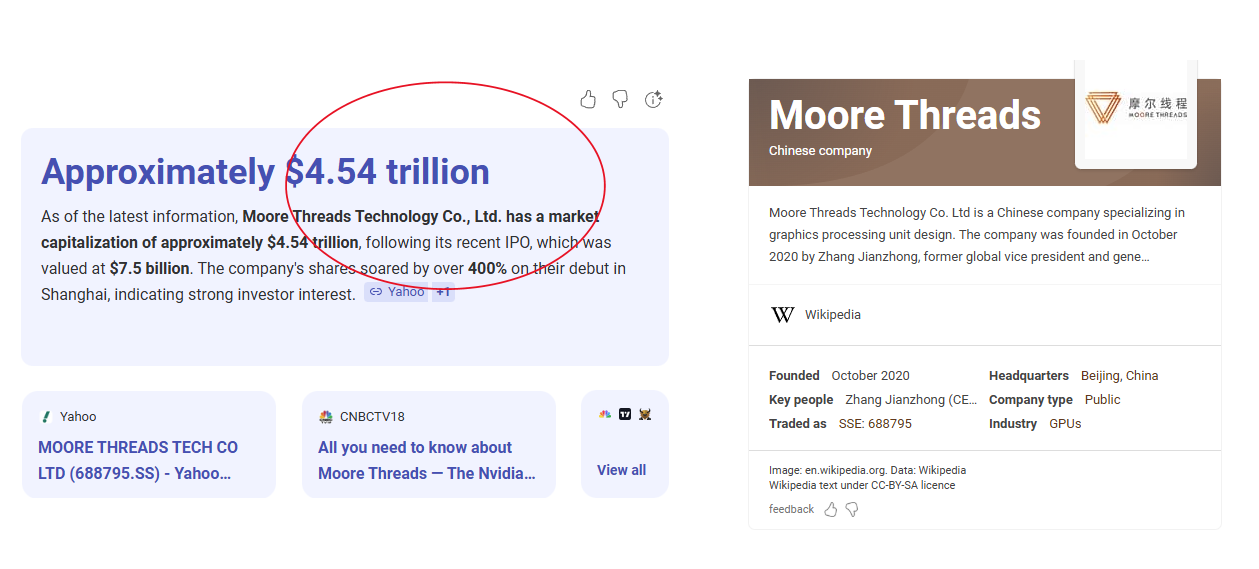

The IPO of a company being referred to as the Chinese Nvidia (not least because its founder James Zhang Jianzhong, used to run Nvidia in China) grabbed a lot of attention as it jumped 400% on its recent debut. Obviously, it does not have a market cap of $4.54 trillion as shown by Google’s AI, that is basically Nvidia, it is nearer to $40bn. However, what is staggering is that $4.5trn is actually the amount submitted by Chinese retail Investors to buy into Moore Threads in what is known as the IPO Lottery.

Fast forwarding IPOs for China tech is part of a savings and investment infrastructure buildout

With an average return on China IPOs this year of around 250%, the once widespread process of retail investors ‘stagging’ a new issue in London or New York is coming to China with a vengeance.

The importance is that the Chinese retail investors can submit bids easily and while there is no upfront payment, the bourse will temporarily freeze funds during the process. And that is the key point for us; that there is in excess of $4 trillion in domestic retail money looking to invest in Tech related Chinese stocks.

Of course much of that is liquidity looking for a quick return, but the importance of retail investors should not be overlooked. The Chinese authorities are certainly watching closely and their aim will be to shift this short term trading money into longer term savings, which is all part of their plan to build a proper savings and investment infrastructure.

Retail is increasingly important in the US too

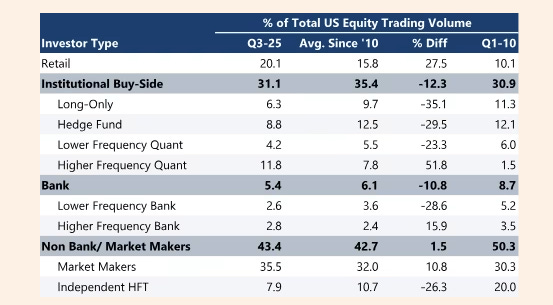

We have already seen it in the US, where we see the shift away from traditional institutions to retail and High Frequency Quant, as detailed in this table from Jefferies (via the FT)

We can see that compared to 2010, the % of retail in US trading volume has basically doubled, while traditional long only has almost halved, leaving Retail at over 3x the size of institutional long only funds. Meanwhile high frequency quant is now the third largest - after Market Makers and Retail.

With the emerging opportunity set in China internet and Chip stocks, US retail may well start looking to play China in 2026 - along with everyone else not otherwise constrained by institutional mandates.

But, to return to China. The authorities have clearly made the IPOs of tech related stocks a priority while at the same time having tighter listing requirements that are limiting the number of issues.

Moore Threads was approved only 88 days after filing (88 is never a coincidence in China as its a lucky number. Most likely is was approved even faster). The company was on the US Entity List, but that has not prevented it from producing four generations of chips so far.

The Google AI that popped up on a search for Moore Threads Market Cap and said that it was $4.5trn is on the one hand a classic piece of AI hallucination, but, on the other, who knows, it could be a prediction?

Moore Threads, like other emerging domestic chip makers, has backers like ByteDance and Tencent, as well as investors like Sequoia China and Shenzhen Capital Group. The raise was modest - certainly compared to the valuations being proposed by Open AI and others for next year - where some are expecting $200bn of issues.

The company is regarded as second tier behind other chip makers such as Huawei, which is private, and Cambricon, which is up 138% on last year, but is now going to be part of the rapidly growing SSE STAR CHIP index, which is now up around 50% ytd.

International investors looking to diversify from Nvidia may well start looking at these more specialised indices - and ETFs that track them - the Star Chip Index may well be viewed as a Star rising in the east….

Really solid analisys on how trade restrictions ended up fast-tracking China's chip independance. The $4.5 trillion retail demand for Moore Threads is wild, and it shows just how much liquidity is sitting on the sidelines waiting to deploy into tech. I've been watching Cambricon too and its intresting how these second-tier plays might actually offer better risk-adjusted returns than chasing Nvidia at current multiples, especially with that Star Chip Index momentum building.

Great read. Thank you again!