A question of perception?

August Market Thinking

The Equity Markets think the US is ‘winning’ and so do MAGA supporters. The Bond markets meanwhile are convinced rates have to fall as the US is heading for recession and obviously the heavily Democrat Mainstream Media are fully onside with this opposite view.

International Investors have been forced to recognise that they have been taking a large, mainly unacknowledged, currency bet in their portfolios and are now diversifying from $ assets, while US Domestic investors see no such problem as 401k programmes buy every dip and day traders find ever new ways to leverage meme stocks.

Portfolio management is thus heavily influenced by perception and perspective, be it political or geographic, risk averse or risk taking (or risk ignorant). In the slow days of August, the biggest risk to markets is not that reality changes, but that perceptions do.

(As usual, please note that this should not be considered investment advice. Please do your own research and speak to your financial advisor.)

After the dramas of the first half, Q3 has started relatively peacefully. July was largely a quiet month for politics and markets, albeit ending with a flurry of activity around the US/EU trade deal, something that was largely regarded as positive for ‘reducing uncertainty’ about a trade war.

Commodities, currencies and Gold were broadly flat during the month, as were fixed income markets, while Global Equities maintained their positive momentum from the second quarter, with the main feature being some catch-up by US equities with the H1 outperformance of Europe and Japan.

With the Trade Weighted US dollar below 100, the pressure for diversification remains for loss-averse international investors, since, unlike domestic US institutional investors, they are now taking an active currency risk for their asset liability matching. This has already shown up in some rotations to the bigger markets of Europe and Japan and also in the currencies of countries like Switzerland and Taiwan, but is also leading to some increased attention into Emerging Markets, Asia and China, all of whom had a strong July.

August and September have poor seasonality for markets as low volumes tend to leave them vulnerable to ‘shocks’. Traders know this which means things are generally quite ‘nervy’ over this period and shorten their time horizons. Meanwhile, investors, mentally, if not always physically, at the beach, tend to extend theirs and reflect on some of the longer term trends they have bought into.

Short Term Uncertainties…US Economy and rates

The bond markets have become quite excited about Trump’s comments on the Fed and in particular about Chairman J Powell, but we continue to doubt the ‘Pivot Posse’, whose self-interest in lower rates to validate their trading positions (yield curve steepeners in the jargon are a very crowded trade at the moment) is mixing with some partisan politics from the traditional media that Trump is destroying the economy to combine and deliver a ‘glass half empty’ narrative.

Trump of course wants the narrative to be one of American success, a strong economy, low inflation and ‘winning’, a glass half full narrative. But he also wants rates lower - primarily in our view because he wants the Dollar lower.

As such, there is some uncertainty about the health or otherwise of the US economy, not helped by the distortions produced in the Q1 data by the bringing forward of imports ahead of the tariffs, an effect that unwound in the Q2 data just out. Also, as we noted previously, the soft data in terms of surveys is now so skewed on partisan political lines as to be effectively almost useless.

Social Media algorithms are amplifying this split perception as Tik Tok, YouTube or X detect your perspective and amplify it. The rapid growth in the use of AI tools risks making this even more pronounced as the disclaimer points out “Chat GPT can make mistakes” and the tendency to ‘Hallucinate’ means that facts become ever more fluid.

Some uncertainty whether the economic glass is half full or half empty in the US. In the UK there is no doubt it is more than half empty

However, there is no such uncertainty (unfortunately) on the state of the UK economy. It is in a, largely self inflicted, mess and is now paying more for its debt than places like Greece. In June it borrowed a record amount, 80% of which went to pay interest on existing debt - much of which was accrued during Covid and which, unlike the US deficit which is funded at the short end, is funded through Index linked bonds, whose coupon cost is rising thanks to other policies boosting inflation.

This is not to be politically partisan. Covid aside, the UK’s current problems in our view stem from the two key Globalist Policies of Open Borders and Net Zero that actually go all the way back to the Blair years. The fact that Team Trump’s major policy moves thus far have been to explicitly reject these policies is highly significant in our view and is giving the US a lead over the UK and Europe, both in terms of energy costs and international competitiveness.

Trump’s Tariffs are increasingly being seen as ‘The US winning’ and are helping drive an exceptionalism trade in US markets’

It was against this background that the EU ‘deal’ struck at the end of July on tariffs has been seen as more evidence of the US ‘winning’ as Trump’s tactic of asking first for twice what you want and then doing a deal that leaves you with (in this case) 15% tariffs.

While still trying to portray tariffs as a disaster, the mainstream media are starting to shift perceptions, as for exampel we can see in this piece from Gerard Baker in the Times. Note though, that the below the line comments are almost all anti Trump still.

Medium Term Risks - lack of diversification

The biggest medium term risk for (risk averse) Institutional investors remans lack of diversification. This is particularly true for International Investors, who now comprise around 18% of the US market because holding US $ assets is now recognised as taking an active currency bet (it always was, but you now might be held accountable for it). The fact that the US is 70% of the World Index means a passive investor tracking the index will still be fully invested, but a Sovereign Wealth Fund, or a large pension fund system like The Netherlands or Australia, or a large insurance system like Germany or France or Taiwan has to think in terms of Asset Liability matching.

We remain of the view that MAGA is actually a revolution of sorts and that while commentators and markets are distracted by a lot of the noise, some profound changes are actually taking place in the background. Most obviously on tariffs, the initial handwringing about inflation and negative impacts on growth are giving way to a realisation that with approximately $4trn in imports, a 15% average tariff is going to yield close to $600bn to the External Revenue Service (ERS) that Team Trump set up for the purpose. This can then lead to zero Federal income tax for 90% of the population.

The risk is that partisan political reporting overlooks some profound structural changes taking place in the US.

Tax cuts for the many would have profound economic and socio-political effects, which is why those currently benefiting from the current setup are opposing it so fiercely. As yet, markets are not thinking about this very much, if at all, but it is a stated part of ‘the plan’ from Team Trump.

Many of the arguments against Tariffs are also heavily partisan and until now have appropriated ‘expert opinion’ on the benefits of free trade to support their catastrophising. We would make several points here: first that we do not currently have free trade, so the purist argument does not stand, we are shifting from one set of trade distortions to another. Second - and this is something that the UK could think about in a broader context - the biggest costs in an economy come from labour, taxes energy and rents, not raw materials, imported or otherwise.

The UK is putting up all those costs in a way that will inevitably be passed through in higher prices. The US is not. As previously discussed, if Canadian lumber price go up 25%, the material cost of building a house might go up by 3-5%, but the cost of a house is the land, the fixtures and fittings and the labour. Equally, more expensive Canadian steel or car parts might force relocation of the supply chain or a hit to margins rather than higher prices. Again as previously noted, the big reason for making cars just over the border in Canada is the lower healthcare costs.

Thus, in our view, tariffs are a combination of a consumption tax and a normalisation of corporation tax through eliminating transfer pricing. They are not necessarily inflationary or bad for growth.

The fact that rather than just paying down debt, they will be offset by a cut in income taxes for those with a higher propensity to spend means that they have a good chance of delivering the growth needed to address the broader Budget deficit. It might not work, but it is largely not even being considered.

Also to throw in the mix, the Pharmaceutical sector has stated that it could easily reduce prices to US consumer if they cut out the middle men, the Pharmacy Benefit Managers.

Long Term Trends - Capital flows and evolving themes

The US Bond markets have long been obsessed with the Monthly Payroll numbers because, in their view, they give insights into the likely behaviour of the Fed. As such, short term traders get very excited about them, but in over 40 years of watching markets we have rarely if ever found them useful for long term investors, especially in equities. It’s rather like sports betting; a lot of excitement ahead of the event, a brief amount of dramatic activity and then back to where we were.

Having said that, one aspect that is worth thinking about in terms of US employment - at least as far as equities are concerned - is the US 401k system, which is effectively a Dollar Cost Averaging Machine that buys US Equities month in, month out. A quick chat with Chat GPT (yes we are aware of its hallucinations) suggests that there are between $8 and $9trn in US 401k assets and that annual contributions from both employers and employees are around $400-$500bn, or around $35-$40bn a month,

If we make a (very cautious) assumption that 60% of 401ks go into Equities, then we have $20-$30bn of flow every month into US Equities, which helps reinforce the buy the dip behaviour. Increasingly we believe this is going into passive ETFs rather than funds or single stocks.

Dollar Cost Averaging meets the DORKs

If this is stabilising markets, we have an emerging system doing the opposite. Mainly since Covid, the US now has significant flows into single stock leveraged ETFs and ultra short dated single stock options, which is transforming the ‘noise’ around markets - especially in stocks like Tesla and Nvidia, but also a re-emergence of the ‘meme stock’ craze, with the new craze for the so called DORK names of Krispy Kreme (DNUT), Opendoor technologies, Rocket Companies and Kohl’s.

The existence of 0 Date Trade Expiry (0DTE) options on these and other heavily shorted stocks is allowing a repeat of the Gamestop and AMC behaviours of 2021, where social media and crowd sourcing can overwhelm the market makers forcing prices to crazy levels (although the market makers always seem to win in the end). In effect FOMO+0DTE = elevated uncertainty.

China building out a long term capital markets savings and investment system is the biggest theme out there for capital flows

Meanwhile, we continue to see the steady build out of a long term savings system in China, partly like the US 401k system but with elements of the Hong Kong Mandatory Provident Fund (MPF) and the Singapore Central Provident Fund (CPF) systems - likely with a bit of the Australian Super Fund system thrown in for good measure.

As we have often noted, the Chinese do not just copy good systems, they learn from bad ones and the mistakes of others. This of course is Charlie Munger’s concept of ‘Inversion’, otherwise expressed as “Don’t do the dumb stuff’. Which is why the UK doesn’t feature heavily as an example to follow.

Long Term Themes evolving

In quieter markets and with more time to think away from the desk, two of the bigger longer term thematics - AI and Defence - merit some second order thinking in our view. For now, they are hot themes and anyone exposed to them is doing well as a stock, but in our view they are both likely vulnerable to the very rapid changes we are currently experiencing and thus need careful monitoring,

To start with Defence. Currently the headlines are all about the commitment by Western governments to spend increasing percentages of GDP with a relatively small number of US and European weapons manufacturers. And yet, as the US/EU trade deal has exposed, this is not something that the EU has a mandate to commit to, Defence remains a national issue and, unlike the EU, national voters have to be considered. So the first risk is that the flows are illusory and the second that commitments will shift in acknowledgment of the real needs.

This is a key issue raised by this fascinating essay by Kit Klarenberg, talking about the constant ‘innovation’ that is going on in drone warfare. We try to avoid talking about the various conflicts in so far as they are both highly partisan and not always relevant to markets, but as this article points our, the, somewhat performative, behaviour of buying Aircraft Carriers and F-35 planes that need perfect runways and constant maintenance is inconsistent with dealing with any actual threat.

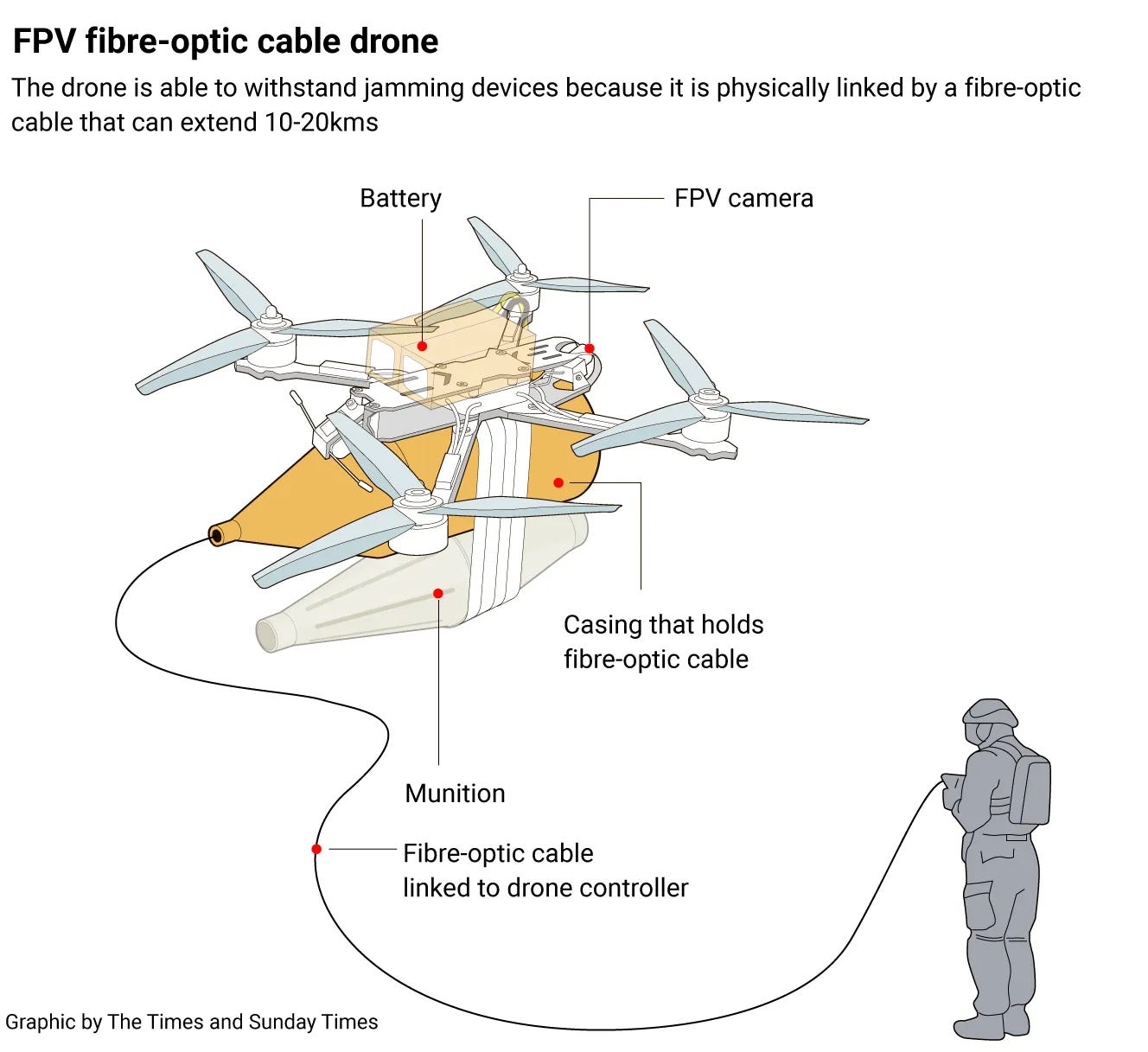

Note that the fibre optic cable, designed to prevent ‘GPS blocking’ is 10-20kms in length! The, very scary, description, of how anyone within 5km (or even 8km) of the official front line is effectively a live target for drones is forcing a complete rethink of Armoured Personnel carriers (APCs) and other troop transportation. Meanwhile, the use of missiles rather than aircraft is also transforming what is actually needed to fight the next war rather than the last one. Often it’s the small stuff. As someone once observed, the most deadly invention of WW1 was probably barbed wire.

In brief, the Military Industrial Complex, (MIC) at least as is widely understood by the equity markets, does not really produce the products that modern peer equivalent warfare requires. Governments know this of course, but as another old expression goes, the job of the MIC is ‘to sell you weapons that don’t work and you don’t need to protect you from a threat that doesn’t exist’.

At some point we will start to see cancellations of the performative products and move from Macro to Micro in terms of where spending is actually going to go.

AI - Over-riding the wisdom of crowds

Secondly, on AI, we have just seen a very interesting milestone development in that Google has just switched its search engine to AI, meaning it is providing vastly fewer links to external sites - and thus delivering less advertising. This threatens to kill the host, since it is the independent media that is providing the information in the first place for AI to collate and analyse. De-monetising that will exaggerate the already concerning trend for AI hallucination.

Google is using AI to undermine its own data sources

This is then breaking the mould of the wisdom of crowds, wherein new information is assimilated quickly and easily (similar to the efficient markets hypothesis) and leaving the new system vulnerable to bad actors seeking to manipulate the outputs by flooding the AI with ‘information’. In the same way that AI is helping people create fake bands on Spotify and fake accounts to listen to them, so a false narrative can be painted by mass ‘astroturfing’ of fake bottom-up opinion and ‘fact’.

There is something of a parallel with Investment Bank Research, where the arrival of the internet at first allowed independent research to gain a much wider audience, but also allowed the quants and the index trackers to thrive, making it much harder to find out what was actually happening, as the main users didn’t care about the ‘facts’.

This suggests to us that the biggest threat to the development of AI is actually the hyper scalers themselves as they try and corner the market. Also that the next job boom will be in independent analysis of the (now distorted) facts.

Also another perspective on the Investment side of AI

The other issue, as we hear that Open AI is proposing using the magic levitation method of raising capital to give it a crazy valuation, is value destruction. Expected to raise considerably more than the $1.5bn it raised last year, according to the FT , Sam Altman now aims to sell an amount that would value it at $500bn, as it projects $20bn of sales. That sales number is actually quite modest - every Fortune 500 company is at that or higher - it’s more that the average company is valued at 2.5x sales (and yes Chat GPT just told me that), not 25x sales.

More pertinently, as Anthropic seeks to raise $5bn on a 40x sales valuation, is the economics of the whole system. As this essay by the great Ed Zitron point out, the annualised revenue number quoted is basically the last/best month multiplied by 12, which isn’t exactly GAAP accounting, and that both companies are burning money.

Indeed, as he has also pointed out, (see the haters Guide to AI) the return on Capital employed so far has been little short of disastrous and it is important to question its sustainability. Those heady multiples of sales both assume and demand constant growth in revenues. Growth that is far from guaranteed.

The Magnificent 7's AI Story Is Flawed, With $560 Billion of Capex between 2024 and 2025 Leading to $35 billion of Revenue, And No Profit

Ed Zitron, from Where’s your Ed at?

As Ed puts it, nobody apart from Nvida is making money out of this. Indeed, the entire construct of AI is about buying GPUs and putting them in data centres for a product that nobody yet knows how to monetise. For context, Netflix has 300m subscribers and revenues of around $40bn.

In a form of Ponzi scheme, new start-ups like Cursor, who raised $900bn for their business built on the back of Open AI and Anthropic, were immediately hit with changes to the terms and conditions such that most of their capital went to the incumbents. No consumers are involved, it’s a passthrough of Venture Capital financing. The valuation of the start up is a function of the valuation of the incumbents, whose growth is driven by extracting huge rents from the startups….

For now, we think that the best monetisation of AI is probably through Robotics and Automation, including humanoid robots - where the leading exponents are, you guessed it, likely to be Chinese, not least because the overlap with EV manufacturing is around 70%. And the first thing that those humanoid robots will do is likely to fill in the 30% of current EV manufacturing that is not already done by robot.

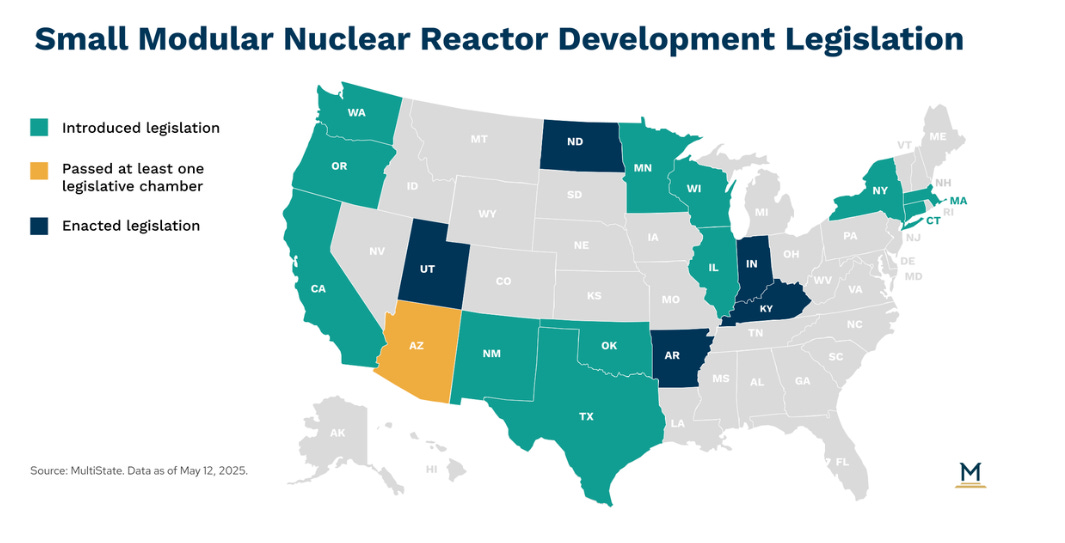

Energy and China

This takes us to our final point about perception and long term thinking. The growth of energy demand from AI is sometimes painted as a threat, but it is also an opportunity. In the US, States are taking the initiative with small modular nuclear reactors and passing legislation to unblock the regulatory bind that has prevented any nuclear development for decades. As the graphic below (taken from here) illustrates, this is advancing rapidly.

By contrast, China’s motivation for alternative energy is not AI, rather it is energy independence and it is advancing across multiple fronts.

The perception on China remains heavily negative, especially in the US, where the facts are presented in a manner to suggest that the US is winning. This is a topic that requires a larger standalone piece, but on energy it is useful to know that China has recently announced a successful build of a Molten Salt Thorium Nuclear reactor - see this video for a great explanation - as well as a milestone in the development of Fusion. Thorium is, ironically, a US developed technology that was passed over in favour of Uranium on account of the military demand for Plutonium produced by Uranium reactors but not Thorium ones. It looks like China has managed to update and perfect the technology. We shall see, but when the UK is spending billions to apparently take Co2 out of the air and store it under the Irish Sea, the contrast is as dramatic as it is maddening (for a Brit).

Either or both developments offer the prospect of cheap energy and energy security ( a point Pippa Malmgrem makes - among many others - in her latest post on substack) and that this is being both driven by and enabled by AI. As Pippa notes, there are lots of fascinating things happening right now on energy; the Japanese are beaming energy from space, the US are also transmitting energy by laser and as she puts it, energy is going the way of landlines.

This is mind numbing stuff for sure and probably needs a pool-side cocktail to soothe the nerves, but to return to the Thorium reactor story and Chinese energy independence, it is worth noting that China has enough Thorium to meet its energy needs for 20,000 years and that is without opening a single new mine, because it is a by product of its existing rare earth mining.

The mantra from renewable energy campaigners is that wind or solar power is free and thus ultimately cheaper. But this is a solipsism, all energy is free, it’s just the cost of extracting it, storing it and converting it into something useful - transmission and infrastructure - that costs money.

If energy is almost free, the consequences for the entire global economy and our financial system would be/will be radically re-orded. That will require the ultimate shift in perception…..