The famous Gilray cartoon of Pitt and Napoleon carving up the world has ironic resonance as Russia and the US meet up in Saudi Arabia this week with UK, Europe and Ukraine are not even invited.

To be fair, this is more about re-establishing US/Russia relations before any progress can be made on Ukraine, but the, now perpetually outraged, EU politicians, still smarting from their telling off by JD Vance at the Munich Security Conference last week, should perhaps be reflecting on the notion that the US may be taking a more Palmerston-like view to alliances…

Therefore I say that it is a narrow policy to suppose that this country or that is to be marked out as the eternal ally or the perpetual enemy of England. We have no eternal allies, and we have no perpetual enemies. Our interests are eternal and perpetual, and those interests it is our duty to follow.”

―Lord Palmerston

1848

The location of the meeting is also telling - in effect it is a sit down between the three largest oil producers in the world. Team Trump understand that lower long term energy prices are crucial to MAGA and that informs the near term Geo-politics. If you want to exert pressure on Iran by blocking its exports, for example, you need the rest of OPEC+ to replace the oil taken off the market, but they are not going to do that in advance and crash their own revenue streams. Equally, the current black market situation is favouring Industrial rival China relative to places like Japan and Europe.

Team Trump understand the importance of cheap energy and the economic self-harm of Net Zero, as increasingly do the voters in Europe - the protests that aren’t against uncontrolled immigration, are about the impacts of Climate Policy. Not, importantly arguing about the Climate, but about the Policies.

As we discussed in Waking from a Fever Dream, the requirement to believe 6 Impossible Things before Breakfast about Climate policy is becoming increasingly questioned and the string of logical fallacies used to defend the project, in particular the use of Ad Hominem attacks is having less and less impact.

This weekend’s vote in Germany will be an interesting in this aspect, for, like Reform in the UK, a key part of the policy pitch from Alternative for Deutschland (AfD) is a rejection of Climate Change Policies held by all parties - but most obviously the Greens. Labelling them as far right extremists because they also reject the other key Globalist Policy of unrestricted immigration is no longer really working, which means, ironically that as voter outrage over open borders spreads, so do does political support for a rejection of sustainability.

Hoist by their own petard, by linking rejection of Climate Change Policies with rejection of open borders, the Globalists have created a coalition against themselves

Equally, anyone in Europe watching with envy as Team Trump take a chainsaw through bloated and corrupt government is also going to be attracted to whichever candidate expresses anti-Globalist opinions in their own country. Given that the vast majority of the Political/Media/Academic/Financial/legal ‘caste’ are not only in favour of Globalism but so steeped in it as to not even contemplate an alternative, the mainstream media are understandably outraged about everything happening at the moment.

In many ways, this feels like Brexit and the last time Trump appeared, with the ‘Elites’ lashing out at everything Team Trump does. Except that, this time, Trump appears to be occupying the ‘Common Sense’ high ground and his opponents are being forced into increasingly difficult to defend positions.

Also European politicians protesting about JD Vance’s comments on censorship just days after a CBS 60 minutes programme showing German bureaucrats gleefully talking about how they have the police kick down doors and fine people thousands of Euros for being rude online about politicians doesn’t stand up well.

Gold

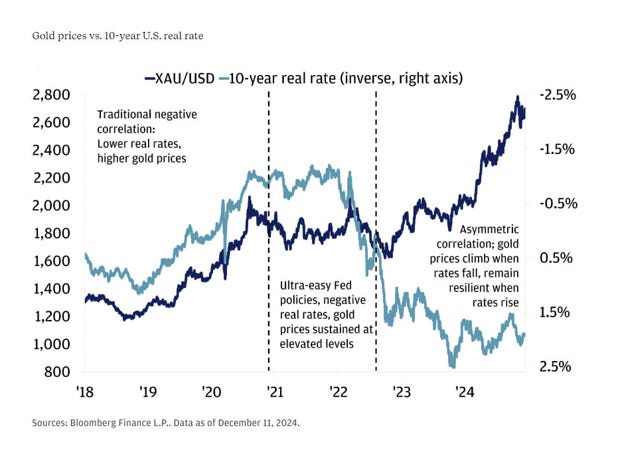

For many observers, the biggest Trump trade has been Gold since, in their worldview, he is causing such uncertainty and chaos that everyone is rushing to Gold. It is certainly in a new bull market, but we are not so sure, this is the real driver. In fact, we think the ongoing bull market in Gold is more associated with the previous US administration, which brought in the financial sanctions on Russia in 2022 and in doing so broke the relationship between Gold and real interest rates.

The Chart (from Bloomberg via JP Morgan) illustrates the disconnect, with, we would argue, shows Gold starting to take over in a proxy role for US Treasuries. Why recycle your US$ earnings into US Treasuries if they can be ‘frozen’ by political fiat? Moreover, the circumstances are such that you can effectively generate a ‘yield’ from Gold through the leasing market.

Gold also appeals to those in search of actual physical assets rather than codes on a computer. An ex-colleague and good friend wrote recently how “The number 13 tram in Zurich winds its way through the centre of the city before turning and pushing uphill to the Uetliberg. The inhabitants of the tram are typically older people and bank employees, but occasionally you might come across a few excited, wealthy individuals journeying to look at their gold in the Credit Suisse (now UBS of course) building at Uetlihof. The entrance to the building is on the 8th floor, betraying a deep underground complex where it is said, the bank stores gold bars, and sometimes invites the owners of the gold to view their stash.”

The transport is likely to be more glamourous when Elon Musk and the teenage wizards head to Fort Knox to check on America’s Gold. While a few people may possibly be speculating that there isn’t any gold there, more Sam bankman Fried than Auric Goldfinger, others are pointing out to a potential revaluation angle.

As Louis Gave and the team at Gavekal point out, the 261.5m ounces of Gold are in the books at their 1973 ‘mark’ of $42.2, making a potential ‘uplift to NAV’ of around $760bn. Of course, as with a company (and we think Trump sees the US as a corporate restructuring), the real reason to reprice your assets is not to sell them, but to borrow against them and should this happen, the impact on markets will depend on what they do with the money.

A Sovereign Wealth Fund for the US

This then brings us onto another intriguing idea has already been mentioned in Trump’s wild first month - a US Sovereign Wealth Fund. As with everything that Trump mentions, the instinct of the commentariat is to dismiss it out of hand, but then come back around to it later.

However, if the US revalued its Gold and then effectively borrowed against it from the Fed to fund the SWF, then the impact on markets would be bond positive (less issuance) and probably not be that inflationary - certainly not in the way of the ironically named ‘inflation reduction act’ that pumped trillions directly into the economy (especially into the Green Industrial Complex).

What to Buy?

What we can presume is that it would make no sense to buy gold, nor does it make sense to hold US Treasuries, (other than perhaps to ‘prop’ the market) but what about stocks and private capital? Well, perhaps an equal weighted rather than a cap weighted S&P500 index - the Alice in Wonderland logic of giving the most capital to those with the biggest balance sheet is even more ‘mad’ for a Sovereign Wealth Fund, but single stocks raise the issue of insider influence (stopping individual stock trading for all politicians is some low hanging fruit likely to be plucked soon in any event).

There would undoubtedly be a long queue of Co-GPs stepping up to assist in allocation - and here again this could sweeten touted legislation to eliminate the tax break on ‘carry’. Some have suggested that a SWF could be a buyer of TikTok for example.

A GIC/Tamasek model has undoubtedly been considered and we suspect that Team Trump are taking a leaf out of China’s long term playbook. Look around the world to see what works and copy it. Just as important look around and see what doesn’t work. And definitely don’t do that.

More radically, we would suggest a return to tax equalisation for income and capital gains to push towards more dividend payouts for investors rather than sharebuybacks that really benefit insiders with ‘free’ option packages.

Pax Americana Perpetual Bonds for ‘allies’?

One other interesting twist, picked up from a Macrovoices.com interview with Jim Bianco - in trun referencing work done at Hudson Bay Capital is that the US requires its allies to compensate for the ‘free ride’ they have enjoyed for the last 80 years of Pax Americana by swapping their, say, 10 year bonds for perpetual notes paying zero coupon in return for continued protection. With interest costs now one of the biggest line items, this would be another way for other countries to ‘pay their fair share’.

Liquidity could be provided by the Fed with reverse repos at par. This hasn’t been widely discussed and, being consistent, will undoubtedly trigger ‘Orange Man Mad’ like comments, but importantly, it doesn’t matter whether I, or indeed anyone else commentating, thinks this is a good idea, it is certainly an idea under discussion and forecasting on the basis of what I would do, rather than listening to what they are suggesting they may do, is rarely if ever helpful.

The new Palmerston like US Government has already made clear that neither enemies, nor allies are eternal, but national interest is perpetual. It would be interesting if the interest on a National Perpetual was then nothing at all.