Market Thinking -August 2023

No second leg to a bear is not the same as a bull...

The equity markets have now recovered over 70% of their decline during 2022, as widespread concerns about a second, earnings driven, downward leg have largely now dissipated. We were reasonably non-consensual at the start of the year in our view that there wouldn’t be a second bear leg and while the stabilisation in the discount rate has helped long duration stocks and sectors like Tech rebound sharply, July started to see some shifts in expectations in areas like energy, mining and financials, where the narrative from the successful Macro Bears of 2022 had been keeping valuations low, but where bottom up realities have started to deliver some changes in opinion. However, while we might regard the absence of a negative as a positive, we remain cautious as to whether we have yet started a new bull trend.

Having said that, as August starts with another wobble in bond markets and a sell off in equities, we don’t think this is a delayed second leg of a bear market either and should remember that at the start, bull markets always have to climb a ‘wall of worry’. Retail may be (overly) bullish, but Institutional investors are overweight cash and underweight equities, in a world where assets are resuming their traditional roles of bonds for income and equities for compound growth and real returns, with cash for risk management, that can not last for ever.

Short Term Uncertainties.

It looks like that was a ‘traditional’ non-recessionary bear market - but bonds currently the short term concern.

The main ‘surprise’ in July at the macro level was ‘the beginning of the end’ for Japanese yield curve control (see Japan, last man standing), which, coming as it does as we approach ‘the end of the beginning’ for normalising monetary policy elsewhere, is starting to create some positioning uncertainties in bonds and FX markets. Essentially the BoJ has not formally ended yield curve control, but shifted its unofficial limit for ‘intervention’ from 50bp to 100bp and not surprisingly the markets are going to test their resolve. In our view, this may well be part of the sell down in US Bond markets in early August, which was otherwise blamed on a Fitch downgrade and a slew of issuance. Certainly the chart seems to support this thesis.

Is Japan the real reason for US Bond weakness?

The bond sell-off is a new headache for 60:40 managers. After the worst year in decades in 2022, the first half of this year had seen encouraging returns, with even long bonds delivering a total return of around 4%. That is now reversed to almost -3% year to date and likely to see 60:40 managers and pure bond managers alike scurrying back to the short end and many high profile calls for ‘now being the time to buy bonds’ looking somewhat premature. Meanwhile, another big influence, the risk parity portfolios, whose models are influenced by volatility, continue to struggle with the high levels of bond volatility, as shown in the MOVE index, especially when compared to the surprisingly low levels of equity volatility in the VIX.

The sell off in long bonds is likely to concentrate managers even more at the short end.

Certainly, looking at our model portfolios, even before the early August sell-off we saw little of interest in fixed income outside of the very short end, unless of course you are forced to own bonds - which to be fair the overwhelming majority of managers are. The main concern for them of course is re-investment risk; the yield on a 2 year bond might look attractive now, but in 2 years time will the new rate be below what you could lock in right now on a 10 year?

Until this latest sell-off we were seeing the response to this concern as buyers coming in at around the 4% level at the long end to ‘lock in’ some anticipated real yield, while traders appeared to be selling around the 3.75% level, creating a seemingly stable trading range consistent with a shift in inflation expectations of a new, 2-4% range, around 200bp higher than the old, more disinflationary regime. However, with many long term investors frightened off by this latest sell-off, which has broken through the previous yield ‘ceiling’, it will likely be the traders who will set the near term direction.

From an equity perspective, the stabilisation in the long bond had translated into a stabilisation in discount rates, allowing a steadily increased shift to focus on earnings’ fundamentals. Looking at our model portfolios for Equity factors, while seasonality for Q3 is not great overall, there is often quite a bit of rebalancing going on under the surface. In keeping with this, July saw global small cap stocks (size factor) begin well, largely at the expense of Global Quality - which looks to have been a source of funding following its strong relative performance during 2022 - before both reversed by month end. Minimum Volatility however, continues to look the weakest of the five factors we look at, certainly year to date, while, despite the noise on US tech stocks, the Value factor, continues to do the best. This mainly reflects the ongoing recovery in financials, as well as the focus on Japan. For the moment, that early August discount rate move has inspired some short term mean reversion, with size hit the most and min vol the least.

In terms of Equity Thematics therefore, it was encouraging to see our pick of European Financials make new highs during July, as both US and European banks recovered from the ‘bank crisis that never was’ back in March. Meanwhile, KWEB, the Chinese Internet stocks ETF has also shown signs of coming to life. Both still have to climb the proverbial ‘wall of worry’ of course, which is why both are significantly ‘cheaper’ than the market at the moment, but risk premia are clearly shifting. Other, shorter duration, themes that are picked up in a Value basket and where opinions are changing, include Global Energy and Global Miners, both of which have been range trading for much of this year, but appeared to break up and out during July.

In part this is due to a pick up in the underlying commodity markets - with asset allocators selling, often for ESG reasons and the leveraged traders often shorting for index basket reasons (see previous discussion about the momentum indices), both sectors have been following spot prices more than usual. The fact that commodity prices appear to have moved higher across the board to hit 8 months highs has thus been good for the associated stocks, although here too, the early August sell off has delivered the proverbial two steps forward, one step back.

Medium Term Risks

Institutions can’t stay in cash forever

Contrarians would see the current high level of confidence among retail investors as a negative - especially in contrast to its low levels in January - but we would note that according to surveys, most institutional investors remain underweight/cautious (see the chart). Thus for them, the biggest risk may be to be out of the market as it goes up. Currently most are heavily in cash - sorry, to clarify, most are allocating more to bonds - which in turn are crowded at the short end, while Equity managers, many heavily scarred from last year, are holding as much cash as they are allowed.

BoA Global Fund Managers Survey

But the problem for both managers and asset allocators with this strategy is the same one that the bond managers face - reinvestment risk. At some point, the yield on US Money market funds is going to fall - most likely to zero % real yield, ie ‘Normal’. While this is a huge improvement on zero % nominal yield, it doesn’t protect against inflation which is now in the 2-4% band. Only equities can do this. More important in our view is that just as Equities are returning to their role of providing real returns and compound growth, so bonds are returning to their ‘normal’ role of providing income. Cash, as we see it, should and will return to its traditional role of risk management. At some point soon we think investors are going to have to address this return to normal.

The new New Normal is restoring assets to their traditional roles; bonds for income and equities for capital gains - with cash for risk management. Portfolios are going to have to adjust

Remember, at the allocation level, flows tend to reflect things they are underweight and are going up, or vice versa. Being underweight equities as they go up is going to get as painful as it was the other way around last year.

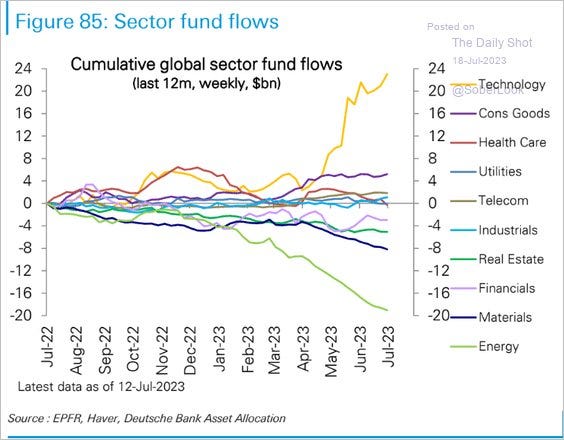

Meanwhile, at the sector level we see this event already happening as managers have chased technology as it has risen. We noted previously that asset allocators were effectively selling S&P500 futures and buying NASDAQ as a way of doing the same thing. But we would also note the cumulative flows out of energy and materials.

As noted above (and in other posts) a degree of this divergence is that traders have been front running the June rebalancing of the momentum indices - in 2022 there was a huge swing from tech to Energy and materials, while in 2023 that has gone the other way. These big indices and the ETFs that track them only rebalance every six months on a simple algorithm that traders can easily anticipate. This June it was reducing Energy and Miners from around 20% to single digits and pushing Tech the other way.

Meanwhile, we would add that the dividend yield available for many of the stocks in the short duration unloved sectors - that might also be characterised in a value basket - are higher than those available in fixed income markets - including cash. This in turn may put in a bid for ‘safe’ high yield stocks, especially as many are in areas that are proving more economically resilient than the macro traders had ‘predicted’. A standout for this is Caterpillar, long seen as a cyclical bellweather, which has just jumped on results and is now up 22% year to date - almost all of which has come in the last month. Caterpillar is also a large holding, by way of example, in the Pro Shares US Dividend Aristocrats ETF.

Long Term Trends.

China won’t stay in the ‘too difficult box’ forever.

Caterpillar’s results were partly seized on for their negative comments on China - where construction activity has not picked up as much as some expected - although this may also involve some market share issues. We note for example that one of their biggest competitors in China, Zoomlion, has boosted its overseas share of revenues from single digits to 24% last year, which both supports Caterpillar’s observations and highlights a threat. Something similar of course is already happening with electric cars, where China’s emerging dominance is leading to lurid headlines about spyware - clearly aimed at a campaign to limit competition by regulation. We would expect the anti China rhetoric to last at least until after the Taiwan Election in January on the basis it is helpful to the US friendly (and thus TSMC friendly) DDT party. Hopefully after that the mutual benefits of trade may re-assert themselves, but with political activism over Chinese companies in MSCI indices effectively extending US political considerations into private investment decisions, this is far from a given.

While we would acknowledge that a lot of the negative press around China is part of a geo-political narrative shaping exercise, it also reveals an enduring mindset. Calls for the Chinese authorities to ‘intervene to boost demand and avoid deflation’ including this one (apologies paywall) is all part of the notion that the role of government is to manipulate the demand side, when almost everything the Chinese have done so far has been about the supply side. The latest announcements on taxes for small business came in the wake of broader comments earlier in July outlining ways to stimulate consumption other than through encouraging borrowing by consumers. Note that we deliberately linked here to the Global Times, because we view their ‘punchy’ editorials as not only a useful counterpoint to the US dominated ‘world view’ on China, but also as an important insight as to what the Chinese policy makers are likely to do - not what US policy makers think they should do. Easing of some restrictions, particularly on property (although definitely not returning to the property speculation of the past) helped the Golden Dragon index of US listed Chinese companies jump sharply at the end of July for a 12% rise on the month. We should immediately acknowledge that it then hit profit taking in early August, but the point is made on oversold and unloved stocks being driven by macro perception.

Many are buying into the ‘China is failing’ narrative in the same way as they are ‘worried about a recession’ and thus underweight equities - it justifies sitting in $ cash for a while longer. Understandable, but not sustainable.

The bottom line is that trying to exclude China from benchmark indices or to prevent western fiduciary investors from owning Chinese stocks is not going to make China ‘go away’. Moreover, there are two sides to the equation and China’s efforts to build an alternate payments system and a BRICS basket based trading currency are a direct response to this increased US bellicosity. De-dollarisation is a process already underway. As we have noted in previous posts, to see this as a challenge to the US $’s role as the dominant Reserve currency is to miss the point, instead, it is going to reduce the $’s role as a transactional currency and the US banking system’s role in international trade.

As we see in the short term uncertainties, the medium term risks and now also the long term trends, flow of funds are crucial, and observable and we ignore them at our cost.

Please note that none of this should be seen as investment advice, it is for information and hopefully entertainment purposes only. Please do your own research and contact a professional investment advisor.