Model Portfolio Changes

Japanese Wholesale Companies and Emerging Market Ex China added to our list of Thematic ETFs.

The Market Thinking Model Portfolio for Global Equity Themes is periodically reviewed to incorporate new Themes and replace old ones that we believe have exhausted their potential. As we recommit some cash to markets in recent weeks, we have taken the opportunity to add to two new themes.

Case 1. Japanese Commercial & Wholesale Trade Index - DXJZ

Sometimes known as the ‘Warren Buffet trade’, the Japanese Commercial and Wholesale Index has attracted a lot of attention in recent months as the asset allocators swung from China to Japan and the Nikkei jumped to hit 30 year highs — although we might interpret that as starting to go somewhere after 30 years of going nowhere.

The original trade put on by Warren Buffet was actually done 3 years ago as a 90th Birthday present to himself and was something we have discussed on a number of occasions in the past. It involved hedging his position by borrowing in Yen at around 40bp and then reinvesting in a number of names in the high yielding (for Japan) Commercial and Wholesale Trade sector, with an average carry of almost 10x - i.e. 4%. Given the nature of the companies’ business activity this was in effect a leveraged trade on global -and particularly Asian - growth, with a handsome ‘carry’ on top.

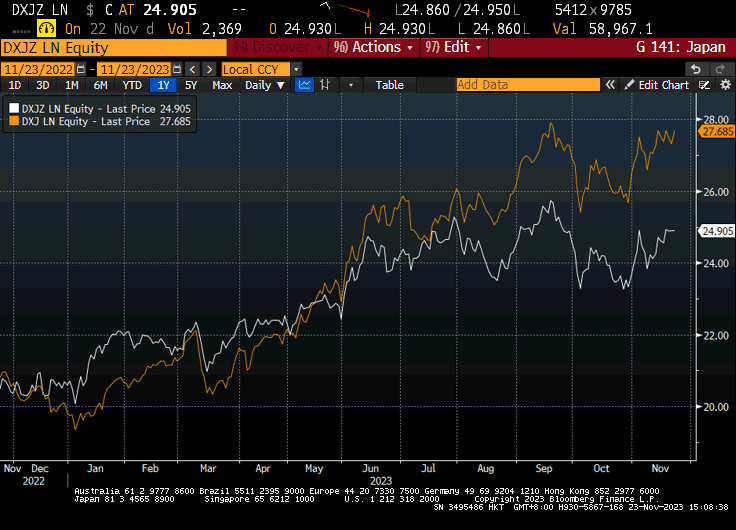

The graph shows the performance of the Wisdom Tree Japan Equity ETF DXJZ- shown in the chart in white - as well as the $ hedged version DXJA - shown in orange. Rather like the Magnificent 7, Japan was a great performer in H1 2023, but note the divergence in H2, as the hedged class outperformed while the unhedged class essentially went sideways. As such, this is clearly just a currency effect, which is an interesting point for a lot of the investors pointing to H2 ‘success’ in Japanese equities.

Second half returns from Japan have largely been offset by the currency for $ investors

Our thesis is that the companies in the EFT we have selected are a dividend-weighted basket of Japanese companies, which fits with Buffet’s ‘Carry plus growth’ theme, but also fit more generally with our ‘longer duration bonds but shorter duration Equity’ view for the next leg in markets. In effect, we are looking for a second leg to the fundamental drivers from H1 2023 and since we are not participating in this trade to take a view on the currency, we are looking at the unhedged version of the ETF.

(Note that DXJZ doesn’t precisely track the Japanese Commercial and Wholesale Index which is the more obvious benchmark, but the only liquid structured note that does so is not UCITS eligible so is not suitable for our purposes.)

Case Study 2. Emerging Market Ex China - EMXC

The second new Theme is based on one of our reference indices, the relationship between a broad emerging market Index, like EEM, and one that excludes China, such as EMXC and reflects what we see as a shift in process to separate China from Emerging Markets.

We can see from the second chart that the Ratio of the Emerging Markets ETF, (EEM) which has a 26% allocation to China to one that excludes China, EMXC, has dropped sharply since August 2021, which was the date that Xi announced that the education sector was essentially not for profit, while talking about Common Prosperity. As previously discussed, this triggered a ‘bear market’ in Chinese ADR stocks, many of which are represented in the China portion of the EEM ETF.

Having underperformed by almost 10%, there was a brief spike in Q2 2022, but as can be seen from the upper graph, that was a case of ‘going down less than other Emerging markets in the wake of the Ukraine invasion and the anticipated disparate impacts in ‘other EM’. There was an actual rally this time a year ago on expectations of China dropping Covid restrictions, but it was clearly ‘sold into’, this time we believe by large scale Western institutional investors who had become convinced that ‘China was un-investable.’ As previously discussed, we believe that a lot of the ‘glass half empty’ stories about China were actually a narrative that emerged to support the market behaviour, rather than actually drive it.

Traders have left China, investors are increasingly looking at it as separate from EM

According to the FT, 75% of Foreign money invested into Chinese stocks in 2023 has left - or to be more precise, 75% of this year’s inflow has gone out again. Most readers will have only picked up on the headline number, but we would see this as a trader based move rather than an investor based one.

We note that, since mid year, the relationship shown in the lower graph has been pretty stable - probably not unconnected with the fact that the outflow is largely over. During the 2000s, we were used to seeing these sorts of foreign flows dominating the Japanese markets as, having largely left during the 1990s, tactical asset allocation driven overseas flows were the main buyers and sellers at the margin and one could more or less predict the direction of the markets from the number of international investors visiting the various Investment Bank conferences in Tokyo - as well as the number of attendees in various company meetings.

EMXC lets us separate China as a sub Asset Class of EM

Because of this shift in behaviour, which we see as a permanent shift in process, we believe it now makes sense to treat China and Emerging markets as separate sub asset classes and have thus included EMXC as a way of playing a diversified group of Emerging Market stocks which will be far less correlated with China. This also allows us to have a more concentrated China China internet related play such as KWEB, where we also have a position.

Portfolio Positioning

The way we manage the Model Portfolios - as well as the UCITS Fund that we manage on the same basis (suitably qualified investors can find more detail here) - is to include new themes on a watchlist and monitor them using our conviction scoring system. We manifest those themes via large and liquid ETFs that track the thematic index. As and when the conviction score rises to levels we deem attractive, we will incorporate the theme into the portfolios via the relevant ETF. With a universe of 12 themes, a full weighting is 8.3% and we have the ability to go to a maximum of double weight. For both of these new themes, the conviction is now high enough that we have allocated some of our cash holdings into these new themes.

The pie chart shows the current weightings, starting at ‘noon’ with 12.5% in Energy Infrastructure and with the two new themes at 4 and 5 o’clock.

As usual, none of the above should be considered investment advice, please do your own research and speak to an investment advisor.