On CNBC last week one of the questions they asked me was (perhaps inevitably ) about the US Election (unfortunately the short clip from YouTube doesn’t include this). My reply - consistent with what we said in the October Monthly Market Thinking- was that investors were likely sitting this out and that rather than trying to predict, they were waiting to adapt. Traders, by contrast, were building and trading baskets of ‘Trump Winners”, versus ‘Harris Winners’ and that currently Trump Winners were outperforming.

However this is not the same as saying that ‘the markets’, are predicting a Trump win, it’s simply how they are currently positioned. The same with the betting markets, bookmakers merely balance out buyers and sellers and take their spread. In politics a lot of people bet emotionally for what they want to happen or indeed what they think will happen and this is often on the basis of their personal view clearly being the one that everyone else should agree with. We saw this in 2016, with both Trump and Brexit - the betting markets were deemed ‘wrong’ because the result was not the same as they were predicting.

However there is a danger that the indicators we use are themselves being used to hedge risks or indeed to manipulate perceptions. Some are talking about how a single French trader has put $28m betting on Trump, but is this trying to influence voters, or is it trying to influence other traders to buy a basket of ‘Trump’ stocks where you are already long? Where exactly is the ‘smart money’ actually targting?

Were people betting on the US Election trying to influence voters, or markets?

The same extends to our interpretation of US economics - which tail is wagging which dog? This time last year there was a lot of talk of a ‘pivot’ by the Fed, not least, with bond yields then at 5% a weak economy would mean Fed cuts and thus a rally in bonds. We said at the time that this was an example of the market tail wagging the economic dog, the market positioning leading the ‘opinion’ on whether the glass was half full or half empty.

Does the consensus economic view also just reflect traders’ positioning?

By January, the bond yield had rallied to 3.8% and suddenly the economic surprise index started turning positive (see chart) as the too gloomy opinion that had supported the Q4 rally in bonds was then exposed by the actual numbers coming through.

But as bonds began to sell off again in May, we then had a new variable; politics. The Trump camp wanted to paint the economy as a mess, while the Biden/Harris camp obviously wanted to paint it as a success. The early summer saw the economic surprise index go negative as the bullish pro Biden consensus once again clashed with reality, albeit now in the other direction.

If Bonds are selling off on a strong economy narrative, they might want to take a second look at who is telling them this

Bonds are selling off once more as surprises turn positive again and the media consensus (pro Harris) pushes a narrative that the economy is really strong. Take the Economist today:

Equally to pick on one paragraph from influential Blogger Scott Galloway in an otherwise interesting post about the problems with young men in America. Quoting a Yale professor in Time magazine, he tried to mix it into a personal endorsement of the Harris campaign (criticising other media for not also doing this) with a ‘You have never had it so good’ set of selected economic stats.

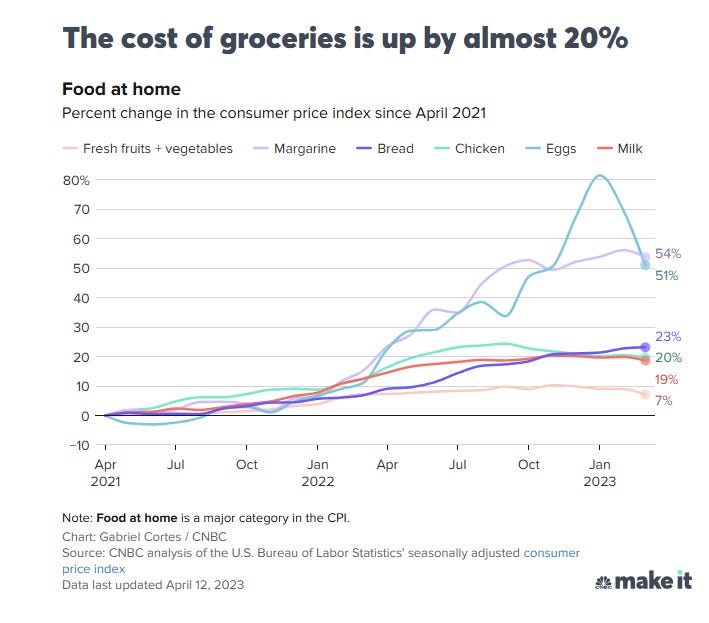

Both are obviously pushing a ‘Glass half full’ view of the economy, but both also quite ‘gloriously’ miss the point that the America of Financiers and University professors is very different to the one of the blue collar, historically democratic, voters who currently seem to be churlishly refusing to vote the right way. Scott Galloway saying that unemployment is historically low misses the fact that for the demographic he is actually discussing (young men) it certainly isn’t - as well as the fact that all the recent growth has come in government jobs - which are rarely good for long term growth and productivity. Equally, saying inflation is down to 2.2% misses the point that grocery prices are up over 20%. And blue collar wages obviously are not.

The other points he makes also misfire. The fact that the stock market is hitting new highs is obviously great for the donor class, but again the demographic he is discussing don’t own the stock market, while cutting the deficit by a third is not the same as cutting the debt. Borrowing less than at the height of Covid is not exactly an achievement - if anything you should be running a surplus.

And as for the growth being the highest in the world - it simply isn’t. In fact even real GDP growth in Hong Kong is higher, as it is in many other places. More importantly, this ‘Glorious economy has come on the back of an explosion in public debt:

Since 2020, US Nominal GDP has grown by $7.3tn, but over the same period US Government debt has grown by $12.2tn

Note, none of this is to make a prediction and certainly not an endorsement, rather that to point out that, as with Brexit and Trump 2016, there are clearly a lot of people who aren’t seeing the glass as half full. Moreover, should Trump win, then there will be an incentive to ‘kitchen sink’ the economy and highlight all the problems we can see to be there behind the thin veneer of ‘Glorious’, while if Harris wins the reality will cut through in the data soon enough.

Meanwhile, the bond markets are facing the reality that whoever wins, the issuance will continue.

Targeted tariffs may be good for US workers, but bad for US Corporates

Currently the Harris campaign are saying very little on actual policy while Trump appears to be focused heavily on Tariffs. Interesting that in his 3 hour chat with Joe Rogan this weekend, Trump stressed that tariffs on ‘other countries’ - but clearly mainly China - would be aimed at persuading them to open factories in the US, which has historically very much been the European approach with Japan and Korea (and remains the case). He specifically mentioned that a mega factory planned for Mexico was now being scrapped on the basis that a Trump White House would make it impossible to export to the US. Very much onshoring rather than nearshoring or friend shoring and probably one reason the Mexican stock market is down 25% over the last quarter.

Trump tariffs are more likely to hit Equities than Bonds

These then would not be ‘inflationary tariffs’ but rather ones that hit the profits of existing US corporations like Ford, GM and Stellantis. Meanwhile the fact that the audience for the 7 minute slots on cable TV coverage of the election rarely breaks six figures needs to be put in the context of Joe Rogan getting 30m hits in 24 hours on his 3 hour special on YouTube and Spotify, highlights the popularity of long form interviews among the, largely young, male demographic.

Starkey on Blair, Brown and the destruction of the UK

Finally, and also in the new media space, the pugnacious historian David Starkey is all over YouTube and other places with long form interviews about how New Labour wrecked Britain. Well worth a watch for, aside from a fascinating perspective on how so much of the problems in the UK today are a function of deliberate policy by Tony Blair and especially Gordon Brown and how it was not only maintained but built on by Cameron, Osborne and Gove, it is also worth noting that he is emerging as the eminence gris of the popular wing of the Conservative Party. He clearly sees himself in the Keith Joseph role to a new Margaret Thatcher.

As the horrors of the UK Budget appear appropriately around Halloween there will still not be an official leader of the opposition, to face ‘Rachel, ‘not actually an economist’ Reeves, but as and when they finish their latest leadership elections it will be interesting to see how Starkey’s views on the need to scrap all the constitutional meddling and Quangocracy are picked up by the opposition front bench.