What just happened?

Equities went down a lot, and then suddenly up a lot. Then drifted off again.

Bonds went up a lot, then suddenly down a lot. Then drifted up again.

But both are still down. Meanwhile, commodities like Oil and Copper are off 20% or more.

Full reflexivity. The media exploded with stories, theories and memes about Trump and his tariffs, which have become important largely because everyone now believes them to be so.

People are starting to wonder if the premium charged for active management might perhaps be worth it..

As ever, none of this should be considered investment advice, please do your own research and talk to your financial advisor.

Broadly we would set up a chain of events so far in April to look something like this:

Asset allocators started to rotate out of US $ assets in late February and early March, setting up a fragile situation for ‘Liberation Day’ on April 2nd.

After an initial sharp sell off, Equity long/short went from leveraged long to flat (or unemployed) as their risk managers shut everything down at the end of the first week, making things even worse.

Chasing ‘flight to safety’ in US Treasuries forced US 10 yr bond yields below 4%, blowing up parts of the fixed income market such as high yield bonds and even Muni bonds, where short Treasuries was the funding position, in a reminder of the LTCM period.

Meanwhile, a lot of people who had made a lot of money running ‘pennies in front of steamroller’ trades in fixed income found that their main funding mechanism - the repo markets - was also now having a spasm of sorts and so they too had to close out positions. Similar to issues in Autumn 2018.

The subsequent liquidity drain meant that large foreign exchange managers - central banks basically - found themselves short of $ liquidity and started selling Treasuries at the same time as a 3 yr auction, so the Treasury market suddenly flipped to selling off sharply. Elements here also of the Liz Truss issues with Asset Liability matching.

The selling by overseas investors of ‘old’ Treasuries, known as off the run, in turn hurt another, widespread but largely unknown strategy, the so called basis trade market where ‘on the run’ Treasuries are hedged against the Treasury futures contract for a spread. Another pennies in front of a steam roller trade having a ‘Minsky Moment’

Oil fell 20%, as did Copper. Notionally because of ‘worries about recession, but more likely because of need for trader collateral. Again a liquidity rather than a demand/supply issue.

A few people with ‘deep insight’ bought leveraged zero day call options on Wednesday, forcing the market makers to buy the underlying and the liquidity providers in equities and ETFs to push spreads out for a record bounce in some stocks. The meme stock/Tesla effect that had been roiling markets in the post Covid era had suddenly hit the whole market.

As bond yields continued to rise, some members of Team Trump suggested that, while not actually caring about the equity or the bond markets per se, there was now a risk of a systemic blow up in funding markets and that a ‘pause’ in the rhetoric on tariffs would be helpful.

Partisan commentary, having flipped from “Trump is causing inflation” to “Trump is causing depression” as they chased the ‘wisdom’ of the bond markets has now shifted to “Trump blinked” or (some variation of) “Trump realised I was right”. Their constant repetition of words like chaos and crisis is fueling uncertainty and keeping the risk premium elevated.

Consensus continues to focus on Tariffs, but these are, as yet, still known unknowns. We suggest focusing on unknown unknowns. Which parts of the eco-system have hidden leverage or liquidity problems that may yet come to the surface?

In summary, we would say that we have seen echoes these last two weeks of almost every type of what we term market mechanics - forced buying and distressed selling triggered by a sudden lack of $ liquidity. This is not to ignore the economics, rather to focus on the plumbing of the financial system.

The Bond markets aren’t voting on Trump, the US economy or anybody’s economic forecast. They are gyrating due to their own low levels of liquidity and high levels of leverage.

Most trading models are based on a form of pattern recognition - made more so by a lot of the recent AI aditions. The problem is, when the pattern changes, nobody knows what to do next

A wild week for markets to be sure. Having gone into April with high levels of cash and Gold - almost 40% of the DART* fund - limited exposure to US tech and an internationally diversified portfolio exposed to things like China consumer tech and European financials, we had tried to avoid the ‘risk management’ of the financial advisor in the cartoon and had largely managed to avoid the terrible start to the month.

However, we still got hit hard on the Monday as markets sold what they could, not what they needed to. While maintaining a view that Trump Tariffs may well have been a catalyst and an ex-post rationalisation, but were not the real cause of the weakness, we were nevertheless concerned that the waterfall effect of hidden liquidity linkages could be precipitating a systemic market crisis.

Rising Uncertainties prompted us to take more risk off…right before the bounce

As previously noted, the technical positions on most, if not quite all, equities have deteriorated rapidly, spiking a number of our key risk indicators on likelihood of distressed selling, especially by leveraged traders. As such, we took the decision to raise cash further on Wednesday by cutting exposure to the Themes flashing 1 (lowest conviction) on our systems and only increase some exposure to the limited number of our Themes we saw as still offering attractive risk reward.

Accordingly, it was painful to see that market rip 13% (or more) overnight Wednesday on the back of an apparent ‘easing’ of trade war tensions. Shot by both sides. But we would do the same again. Hindsight is always the best investor and a degree of procrastination would certainly have helped, but that would to play the scene from Casino Royale, where Bond learns La Chiffre’s ‘tell’, but still loses his first big game because Le Chiffre gets a lucky final card. Risk management is about uncertainty, and uncertainty levels remain elevated.

This is the reason we have constructed our systems, to try and take the emotion out of investing as much as possible and, to our earlier reference, when the market is selling what it can, not necessarily what it wants to, that is a further indicator of risk.

An Equity Market that rallies 13% over the course of a single trading session is actually one that worries us as much as, if not more than, one that goes down 7 or 8%. The latter is almost certainly a sign of distressed selling, while the former is (usually) a short term squeeze that can trigger instability and distressed selling elsewhere.

One trader’s leveraged long can often be facing another trader’s leveraged short.

The key now is where buying dips meet selling rallies

As I said on CNBC on Tuesday, instead of talking about a bear market as one where stocks have fallen 20%, we prefer a definition as being one where rallies are sold and this appears on the charts as a series of lower highs and lower lows. The opposite of course is defining a bull market as one where dips are bought and we see higher highs and higher lows.

Experience tells us that distressed selling is far more persistent than forced buying, which is not to say we don’t trust this bounce, rather that, as yet, market behaviour is a known unknown (in Rumsfeld speak), while there are also likely to be some unknown unknowns out there that would be the trigger to turn this into a proper bear market, or a new bull market - albeit led by different stocks.

Historically, markets have selloffs like the one that started in March after a long momentum phase that has brought in passive money and leverage. It is often mixed with illiquidity and an illusion that so long as volatility is low, so is risk.

At some point, actual risk management kicks in and closes books down, triggering margin calls and more deleveraging. Distressed sellers are not in a position to set prices and the market ‘clears’ at much lower levels.

This then is what we believe happened at the end of last week and the beginning of this week. The Trump tariffs were the trigger for the unwind, not the cause of the distressed selling. Myriad notes and articles about recessions and ‘Dumb Policies’ have now fueled a climate of uncertainty, but were not the original story.

The bounce - more likely to be Gamma hedging than a classic short squeeze

However, it is unlikely that the bounce on Wednesday was a classic short squeeze, since most of the leveraged traders had been sat on the long side until the end of last week and, indeed, we understand that it was the risk management teams shutting books down that cause the sell-off that spilled over into Monday.

But what would have triggered the buying? We are also hearing about some large buying in zero day options, particularly in some of the leveraged index ETFs. Market makers trying to hedge those positions (known as gamma hedging) would be forced buyers of the underlying stocks. This is the type of technicality that periodically spikes meme stocks, like Gamestop and, more famously, Tesla.

But what about the other signals? What Unknown Unknowns are there?

Just as a sudden rally in Equities should make us concerned rather than happy, so should a sudden rally in bonds. even more so when it is followed by a sudden switchback reversal as we have just seen.

Initially, we pointed to the response from Bond markets to the tariff announcements as a positive, in that they were (we thought) buying into the lower Budget deficit argument, rather than the, then prevalent, runaway inflation argument.

Here it is important to recognise that the mainstream media is, and remains, 95% anti Trump and will adapt whatever stance is damaging to him. Thus, the early ‘inflation’ argument saw the bond market rally and pivoted into a ‘recession’ argument, using the bond market to support their case.

We have (kind of ) seen this movie

It is not to defend Trump to point out that there is, as yet, no evidence for either case. Rather, we think it important to consider that there may be something more significant for investors happening. There is now a meaningful risk of a classic liquidity crisis from the ‘pennies in front of a steam roller brigade’ in the fixed income markets.

This expression first came to prominence in the 1998 LTCM crisis, when it turned out that the self declared ‘smartest guys in the room’ at Long Term Capital Management (LTCM) were as one wag put it at the time, “neither long term, nor had a clue about managing capital’.

They (and their many clones) were essentially short Treasuries and long a variety of relatively illiquid fixed income instruments, like Danish Mortgage Bonds, picking up a yield spread and also some attractive capital gains as money chased the strategy.

However, as Nicolas Taleb and others were later to point out, the small, positive payoff from the strategy working was dwarfed by the appearance of a Black Swan - something they had failed to take account of in their models which basically wiped them out. As Hemmingway famously put it, they went bankrupt first slowly, then all at once.

In this case the ‘genius’ of the strategy worked until the Russia debt default in the summer of 1998 led to a flight to quality in USTs, leading in turn to a scramble to cover the Treasury bond shorts and an even bigger scramble to sell their illiquid bonds into a market where there was no longer a bid (since the only buyers had been all the traders putting on the same strategy).

At the time, I had something which would politely be termed a ‘standoff’ with my economic colleagues at UBS (I was a strategist) as they insisted that this was all to do with their economic forecasts of ‘Armageddon’ (yes really). To a man with a hammer and all that, but once again, I would see this as being a market mechanics rather than an economy issue.

The time when things did spread however was in 2008, when Lehman and others got a Margin call on their latest ‘Too big to fail’ leveraged strategy, this time in Mortgage Backed securities.

It spread (in our view) primarily because in marking all Lehman bonds to zero the regulators unintentionally blew up the Commercial Paper market, which at the time was essentially providing most corporate Treasurers with their equivalent of short term working capital.

This was a classic unknown unknown and it was only when the Fed started suddenly buying Commercial Paper (because the Money Market Funds effectively stopped overnight) that we were able to work out the way the ‘financial plumbing’ was in difficulty.

We were reminded of the epic scene (from a scenery eating Jeremy Irons) from Margin Call. and the likelihood that Trump said something similar this week to Scott Bessant.

“Speak to me as you would to a young child, or a golden retriever..”

Scott Bessant is very aware of the interconnectedness of the fixed income markets and the role of seemingly obscure corners like repo markets and basis trades. He was the man sitting next to George Soros when they broke the Bank of England.

Bessant will have explained to Trump the importance not of the Bond Market per se, but of the complex financial plumbing around it.

Thus in our view, we see the week having ended, not with a capitulation by Trump, but rather with a quiet word from Bessant and others not to cause a capitulation in fixed income markets.

Tariffs aren’t going away, but we have to hope uncertainty and illiquidity will.

Apologies for such a long post, as Voltaire would say, I didn’t have time to write a shorter one….

And finally. Chasing links on substack…

Noting that my friend Louis Gave of Gavekal appeared on a webcast that appeared in my substack feed, I heard a cross reference to another substack called trader ferg. Checking his latest post, I saw, perhaps not too surprisingly, he linked to an article by Louis’ father Charles, essentially making some similar points to those I made in my own post about the taxation of multinationals.

While I might claim (near simultaneous) thinking with the great man this month, I absolutely defer to him and Louis on the concept of platform companies - their term for what this is all about.

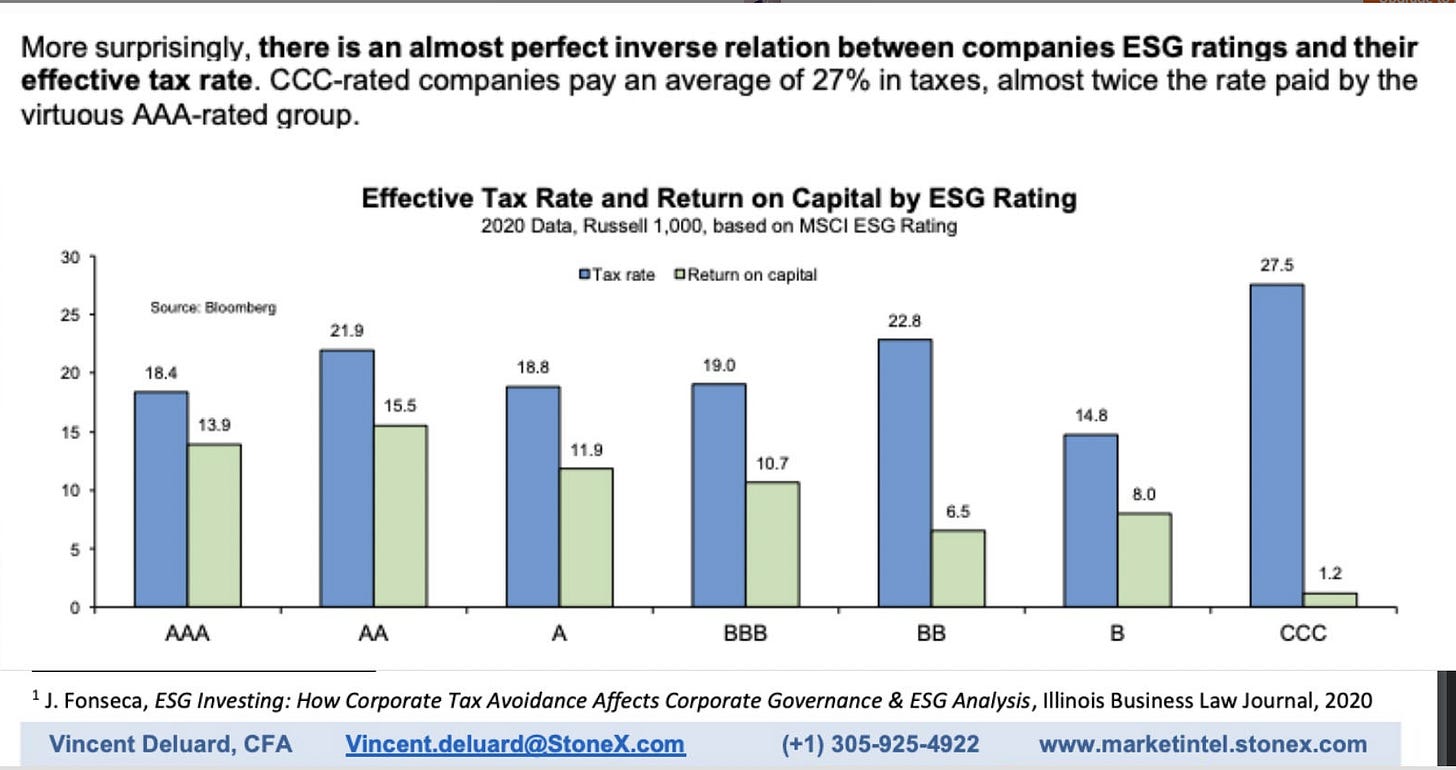

The marvelous thing about substack is it is generating a community of really smart idea and I am more than happy to share. Thus trader Ferg has put up a great chart, which he got from Vincent Deluard, who based it on work by J Fonseca.

The title says it all….

who do you deem as " people with ‘deep insight’ "?