The so called Magnificent 7 stocks in the S&P have dominated returns this year, contributing 95% of the returns in the S&P500 year to date, while the equal weighted S&P 500 is actually down. Interestingly this years’ positive contribution is almost exactly equal and opposite to the negative contribution a year ago. The question then for 2024 has to be, will this mean reversion, now turned into momentum, extend into 2024? Or will it revert again?

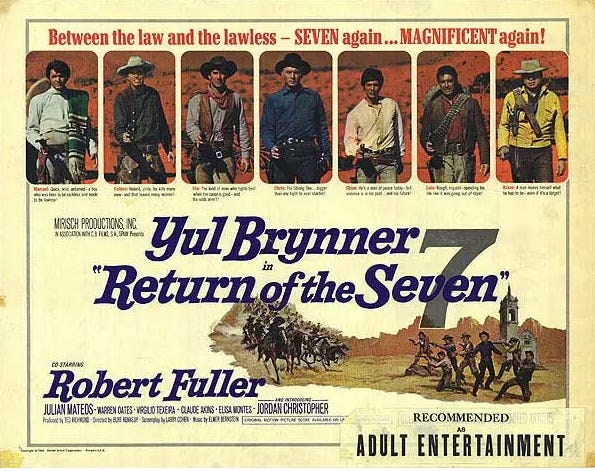

The Magnificent Seven, based on the 1954 Kurosawa's Japanese film the Seven Samurai, was regarded as a near perfect movie by many critics. It’s two sequels, Return of the Seven and the Magnificent Seven Ride! much less so. Will this also happen with the so called Magnificent Seven mega cap tech stocks?

The rally through the first half was a mean reversion, based more on value than earnings growth

If we start with the graph, which shows the Bloomberg Magnificent 7 price index relative to the S&P500 (white) and the Equal Weighted S&P 500 (yellow) and indexed to January 2022 = 100. We can see that, just as 2023 has been all about the M7, so was 2022 – but that it was in the other direction.

The first half of 2023 was essentially mean reversion from 2022

We can see that, against the S&P 500, the Magnificent 7 underperformed by 35% during 2022 and against the equal weighted (in yellow) by even more, at slightly over 40%. The cruelty of market mathematics is such that in order to recover a 40% drop, a stock has to rally by 66%. As such, we can regard the dramatic rally in H1 as simply unwinding the previous selloff.

Second leg fueled by anticipation of new earnings growth, centred around AI

The second leg was more about increased confidence in earnings mid year, particularly around the opportunities in AI and can be seen from the expansion and contraction in the forward multiples in the second chart, showing 12 month and 24 month forward P/E multiples based on Bloomberg forward estimates data for the M7.

M7 Forward P/Es expanded and contracted as expectations of higher earnings came through

Broadly though, we would argue that the mean reversion started from an oversold and ‘cheap’ position of a 20x 24 month forward earnings (blue line). This reverted back to a ‘mean’ of around 25x in Q1, ie a 25% jump in multiple. Prices then stabilised before the multiple jumped again to 32x in anticipation of higher earnings - which subsequently came through such that the ratio dropped to 25x again. As such we could argue that the price return has been a combination fairly equally split between multiple expansion and earnings’ growth.

A narrative always appears - this time it’s AI

As always happens, a narrative appears to support the momentum move - after all nobody wants to admit that they are merely chasing performance. And in this case it is AI, which dominated the headlines in the July/August period, even though it was really only two stocks - Meta and Nvidia that actually demonstrated this in earnings upgrades.

Indeed, if we look at the actual individual earnings forecasts, Tesla, Amazon Microsoft and Apple are all actually slightly lower on the 2024 GAAP adjusted forecast basis, while Google is up around 13%. It is only Nvidia and Meta that have seen the large earnings revisions. In the case of Nvidia it is specifically mentioned as to do with AI and the current 2024 forecast are double where they were a year ago. The same is true of Meta, although importantly earnings are only back to where they were at the end of 2021.

By comparison, the wider S&P, as evidenced by the equal weighted index and as noted is essentially unchanged in terms of price, forecast earnings and (hence) forward multiple, and P/Es remain at effectively half the level of the M7. In effect for the M7 to out-perform from here, they would have to do so on relative earnings growth as the buffer of ‘low’ relative valuation has gone. Indeed, if anything, they have flipped back again to excess valuation.

For Asset Allocators, M7 have totally dominated the last two years - more fear than greed.

With our Behavioural Finance hat on, the sheer size of the market cap effect has meant that the roller coaster in these stocks has dominated Asset Allocators’ minds for the last two years. Being overweight something going down causes fear and selling, while being underweight something going up leads to panic buying. The Bloomberg Chart of the Fear and Greed Index illustrates the emotional roller coaster, showing Price, Volume and the Fear and Greed Index they calculate.

This effect can be seen from the tables of Contribution To Return for 2022 and the year to the end of October 2023. We can see that the M7 stocks had an average weight around 22-23%, and added 10.14% points ytd - 95% of the total return of the S&P500. This was almost the inverse of last year, where they subtracted an almost identical amount. For an allocator, this is the only decision that mattered.

M7 - Contribution to Return - 2022 and Ytd 2023

Source Bloomberg

In 2022 it was about Value (too high) and then momentum. In 2023 it’s been about Value (too low) and now momentum. What for 2024?

For 2024 then, there is no relative value buffer, if anything it’s the opposite, and, if 2022 taught us anything it’s that any miss on earnings will be hit hard. To continue to out-perform, the M7 will have to continue to outperform significantly on earnings in our view (at this point we should of course repeat that this is not to be considered investment advice, it is for information purposes only and you should do your own research and talk to your investment advisor).

Our feeling is that it is not dissimilar to 1999/2000 when, correctly excited about the internet, markets pushed stocks like Cisco to ludicrous multiples as there was a lack of obvious ‘winners’ outside of the ‘picks and shovels in a goldrush’ angle. The real winners from the internet – three of the M7, Amazon, Apple and Google didn’t even exist at the time and the one that did, MFST did nothing for years.

The problem with these new paradigms is that the early incumbents do not have the ‘moats’ they do on their existing businesses - think Nokia, Blackberry, Vodafone etc, all of whom were at one point seen as similar ‘winners’. The news over the weekend of Microsoft’s Open AI losing several key players is one example of the relative fragility of early stage investing. In the meantime, one of the most interesting AI at the moment looks to us to be the one from Elon Musk, called Grok. But we can’t invest in that.

As for the Magnificent Seven, it is perhaps worth noting that by the end of both the movie and its sequel, four of the original seven were dead.