Red Team versus Blue Team - TPP Redux

China is not the target, Europe is. The US aims to absorb European consumers and capital into its orbit to compete with China and the BRICS.

‘Trump’s Tariffs aren’t going away, as they are the core of multiple strategies including shifting the balance of tax from the public to the Multinationals, balancing the Budget, pushing the US further up the supply chain and using economic rather than diplomatic or military power to maintain US dominance. At least of ‘The West’.

In part they are a revisit of the 2015 Obama attempt to change the putative TPP trade partnership to exclude China, the TPP ultimately being shut down by Trump in 2017.

The Anyone But China (ABC) policy emerged in the wake of China’s ‘Made in China 2025’ plan that woke corporate America to the threat of China as a producer of high end products.

A decade on, China is at the top of the global supply chain as a producer, while the US is at the bottom as a consumer. But we believe that the immediate competition for the US is not actually with China, but with the EU and NATO countries to dominate the ‘Blue Zone’.

The tariffs are thus about establishing a Blue Zone where the US can take on the role that Germany previously played within the EU, as the chief producer within a giant customs union.

They are also about bringing the profits of US multi-nationals back onshore and shutting down transfer pricing while at the same time encouraging ‘allies’ to invest in onshore US to access consumers and cheap energy.

Third, along with the security ‘threat/promise', they are the political stick with which the US can create ‘Greater USA’.

Finally, they are about allowing US capital to buy European and NATO equities while selling them US debt.

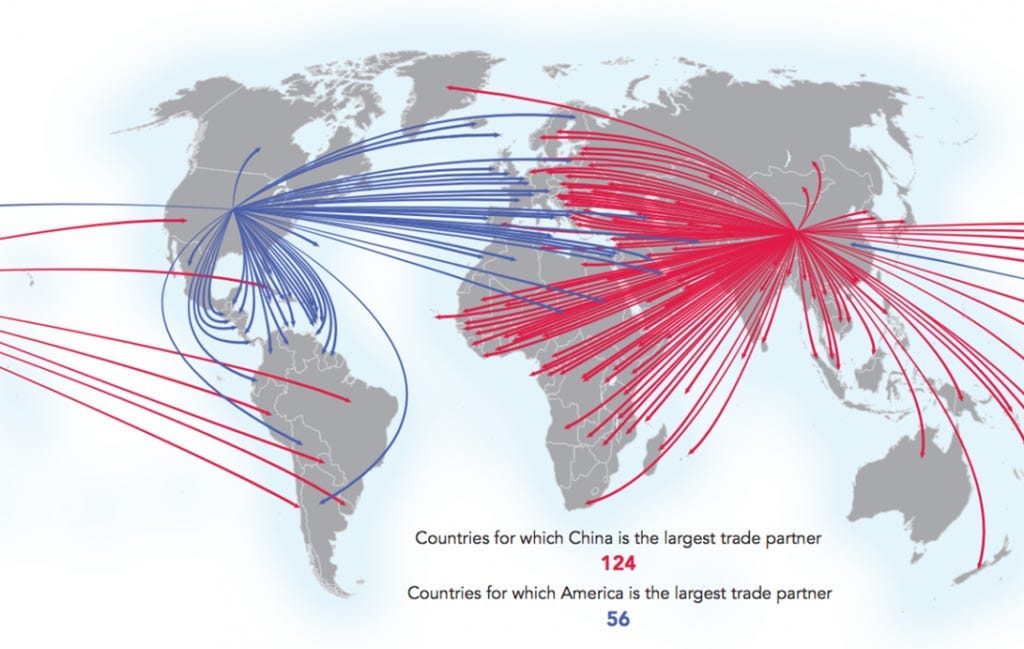

With the next stage of discussion about trade, we thought it worth re-posting the image from a previous post of Red Team versus Blue Team.

The idea that the 124+ countries for whom China is the biggest trading partner are somehow going to give up that trade in order to please the US is, as they say, a bit of a stretch.

Meanwhile, the idea, suddenly popping up across all our social media feeds, that without its exports to the US, China will collapse, is gaining traction again. For context, Chinese exports to the US are around $440bn, which is around 12.5% of its total and around 2.3% of China’s GDP. See this great post for all the details.

More important, the major component of China’s exports to the US are no longer the cheap toys and clothing of common anecdote, but are predominantly tech components and things like active Pharmaceutical ingredients and rare earths. The US relies on China for 532 key product categories, whereas China’s imports from the US are easily substitutable products like Soya beans and agricultural products.

The reality is that we think the US will try and create a large Customs Union with its ‘allies’ to compete with China - i.e. get Europe and parts of ASEAN to put up a tariff wall against China to allow the US to move up the supply chain.

In a post 2 years ago on the Market Thinking blog, called The 99 states of America we said the following:

…. In our view, the most likely outcome of the war in Ukraine is that the world splits into a NATO + Japan/Korea $ zone, containing around 1bn people and with a collective GDP of around $50trn and a non $ zone containing the other 7bn people with an almost equivalent level of GDP, but where all the growth is. Thanks to Zero Interest rates, US private equity is now sitting on $3 trillion of dry powder that will be used within the $ zone to take ownership of the best businesses and thanks to Zero Covid supply chains to outside the $ zone have already been disrupted, allowing for new $ zone chains to be built. Finally, thanks to zero carbon, the US consumer and producer continue to enjoy the cheapest energy within the $ zone and thus will be the biggest beneficiaries of re-shoring and re-industrialisation.

Continued belligerence, not just against Russia with its cheap commodities, but also against China with its industrial competition, will almost certainly be used to establish a new form of Mercantilism, albeit with ‘free trade’ within the $ zone. Sanctions will act as a common tariff barrier, while ‘Global initiatives’ on tax and regulation will result in a largely common policy framework. This would of course be similar to the policies used by 19th century America, although would now extend to 99 states, not 50. The rules of course would all be made by the ‘multi national bodies’ like the UN, the WHO and the BIS, but where of course it is the US FDA, the Fed, the SEC and the US State department that actually direct policy.

In effect it would be like a reverse takeover of the EU by the US, with Australia, NZ, Japan and Korea added in. As the other NATO members pick up half of the $800bn Pentagon budget to establish the hard borders of the $ zone, (the AUKUS deal on submarines being an obvious example) the US can continue with subsidy programmes like the risibly named Inflation reduction act, which effectively subsidises reshoring to the US in the name of Building (the US) Back Better.

Investors need to think how companies, sectors and even countries will now fare within this new $ zone. The best will like be taken into foreign (US) ownership, while the less able will find themselves deprived of resources or subject to unfair competition. Industrial policy will favour those with cheapest energy and best access to capital, which means the US most likely. Emerging Markets will now be the non $ zone and, assuming that the ESG world allows investment there (not an idle threat), investors in the $ zone will have to deal with a new level of home country bias. Interesting times are ahead…..

We would like to think that this analysis has worn well, with Trump’s policies now simply accelerating strategic policies already in train. In other words, this is part of a longer term strategic plan - not just Trump ‘chaos’.

As we have discussed elsewhere, the tariffs are symptomatic of a strategic shift in US foreign policy as well as a key (new) feature in raising revenue to reduce the budget deficit - most specifically in ‘persuading’ US multi nationals to pay their taxes one way or another.

Note that a significant part of Europe’s ‘unfair’ trade surplus with the US comes from US multi nationals transfer pricing

As we highlighted in Fast and Slow Thinking, the so-called trade surplus between Europe and the US is, in fact, almost entirely down to the transfer pricing activities of US multinationals, who sit their ‘international subsidiaries’ in what are effectively tax free zones in Europe. Either they voluntarily change their practice - perhaps ‘encouraged’ by the EU in order to reduce tariffs on actual EU exports - or they pay tariffs to import their own products into the US. The higher transfer price they charge (to minimise US Tax) the higher the external tariff.

This is poacher turned gamekeeper stuff and like much of Team Trump is circumventing the existing ‘system’, which is so tied up with lobbyists and lawyers as to make it almost impossible to change the status quo.

To conclude - Tariffs aren’t going away.

The tariffs have multiple aims, but the focus on creating a Blue Zone and a Red Zone dates back to the Obama era and the recognition that China was a competitive threat. Tariffs are ‘bad’ in so far as they compromise the benefits of free trade, but that is to suppose that we had free trade in the first place. Indeed, Trump’s whole rhetoric about reciprocal tariffs, while classically overblown nevertheless makes this exact point. The irony is that Team Trump want to eliminate trade barriers, but only within their zone of control, which is why they ‘went after their allies’ first.

Team Trump want Free Trade, but only within the Blue Zone

Similarly, the assembling and maintaining of US influence and of a Greater US at the point of a tariff, rather than via diplomatic and often covert pressure from the US Foreign Policy establishment, reflects the ending of the soft power of US multinationals, who are now seen as having benefitted disproportionately from the old system.

The fact that US Multinationals are now to be taxed - one way or the other- is perhaps the key takeaway for investors, along with the fact that the economic consequences are almost certainly not as dire as projected. Even a 15% Global Minimum Tax rate (as proposed by the OECD) would have a meaningful impact on the Earnings Per Share upon which the stocks are valued.

Corporate Profits in the US, having cycled between 4 and 6% of GDP since the 1940s, broke higher in the wake of the Global Financial Crisis and recently hit almost 10% (offset by an equivalent fall in worker compensation). MAGA is about changing that dynamic.

In the same way that Team Trump claim that around $600bn of tariff revenue would allow them to take 90% of the population out of income tax altogether (this reliably churlish ‘fact check from the CFR doesn’t really undermine the point in the way they think it does), a focus on the 90% rather than the 1% means that while the media classes may obsess over their stock portfolios, the re-election focus for MAGA is on the popular vote.

Thus tariffs are about raising revenue to balance a budget, giving income tax cuts to the majority, establishing not just Canada as the 51st State, but a whole another 50 States in a Blue Zone under US control to compete against China, taking the role of Germany as the EU’s low energy manufacturing base and capturing European capital flows and equity assets.

To achieve this means taxing the mega corporations and by extension the mega rich and upsetting the Political/Corporate nexus that has increasingly dominated the US economy over the last 40 years. That’s why they are being protested, but that’s why Team Trump will keep on going.

Please note that none of this should be considered investment advice. Please do your own research and speak to your investment advisor

Thought provoking.

In various forums Yanis Varoufakis (who I believe is well worth taking seriously too) seems to get to a similar place to you by seeing the tariffs as part of a negotiating strategy that Trump is deploying country by country. If I have understood him correctly this is about pushing surplus countries to allow their currencies to depreciate versus the dollar while simultaneously not liquidating their dollar holdings. At the same time they would be pushed to invest in the US. On this line, Trump is aiming to square the circle of improving US competitiveness whilst not weakening dollar hegemony. His argument does not seem specifically to address transfer prices or the role of US multinationals though in creating the trade deficits.

Varoufakis then suggests that this approach may lead to two camps in a similar way to your assessment: countries that play ball and those that do not. His argument (if I have understood him correctly) goes on to argue that if US trade deficits fall or even turn to surplus over time then by definition there will be less foreign capital flowing into the US and that this will hit the financial class that earns returns on the back of this. That would then be a major political challenge that could derail it. But your “bloc” logic works well for me: the US financial class would earn its returns anyway in this new world by buying up the non US “free world” instead of recycling foreign money into the US.

Clearly Varoufakis is not saying that he “likes” the Trump strategy either and I hope I have represented it fairly. It’s an ingenious argument that is a good alternative to the “mad Trump” narratives.

what do you mean by "thanks to Zero Covid supply chains to outside the $ zone have already been disrupted,"?