Little Fires Everywhere

The strong markets in the wake of the US Election were largely a reflection of a reduction in uncertainty; the uncertainty over who would win (as we discussed in the October Market Thinking Pause, Rewind Replay) as well as the uncertainty as to how the losing side might respond - with memories not only of 2020, but also the protracted ‘hanging chads’ election of 2000.

That uncertainty has now been replaced with a new uncertainty over what actual policies might be. A key lesson from Trump 1.0 was to take him seriously, but not literally, to watch what he did, not what he said. At the moment we remain uncertain as to what he really means about tariffs, about reforms and exactly how he is going to MAGA.

And yet, market seem certain about everything being ‘Great Again’. The current risk we see in markets is thus that the post election excitement is pricing in possible winners, but not possible losers. There is too much (false) certainty about a Golden Age and importantly, if some of the reforms being outlined do indeed happen, then that may actually be bad for US corporate profits. After all, the very crony capitalism that the voters just rejected is a major factor in US corporate profits as a % of GDP being near all time highs. What is good for the Budget deficit, may not be good for the stock markets.

Meanwhile, the Biden era is closing as it started, with a long term civil war stalemate collapsing in a matter of weeks, timing no doubt accelerated by uncertainty about Trump 2.0. Ironically, and brutally, this bad news (more death and destruction in the Middle East) may turn out to be better news for markets, if as we suspect there is some trade off for ‘old school’ asymmetric warfare in the Middle East in exchange for an ending to escalating nuclear standoff in Ukraine.

Short Term Uncertainties

The uncertainties in markets are largely centred around the substance of Trump 2.0; what he is going to actually do with tariffs, how much Elon Musk’s DOGE department is really going to be able to achieve and what latitude Robert Kennedy jnr is going to have to go after big Pharma and Big Food and Ag.

The most certain of policies looks to be ‘drill baby, drill’, with new Treasury Secretary Scott Bessent citing a further 3m barrels a day as one of his 3/3/3 policies. The fact that the other two are reducing the Budget Deficit to 3% of GDP and achieving 3% growth point to a shift from Government to the private sector, which while to be welcomed economically is going to create some major losers in the corporate sector. Many of which are heavily weighted in portfolios.

Foreign policy is also a mystery, which is why we are seeing ‘little fires everywhere’. Trump 1.0 had wanted to withdraw US Troops from Syria, which is almost certainly why there has been a late rush to claim parts of the already fractured country ahead of Trump 2.0, with different rebels supported by different factions (amazingly all from ‘the west‘) scrambling to get to Damascus first. Some want to block the pipeline of arms from Iran, while others want to build a pipeline for gas from Qatar to Europe. Some want balkanisation of the region and others want regime change in Iran. All felt the need to move now.

Ahead of the inauguration, markets are thus ‘noisier’ that usual and with long term investors and allocators on the sidelines, things have been left to retail investors and prop traders - mainly in bitcoin and currencies.

Bitcoin ’failed’ at 100,000, its big figure phobia cutting in once again, so the traders turned to the Euro, aiming to push it to its own big figure of parity as France joined Germany and the Netherlands in the Polarising Politics of Populism versus Globalism. The Euro collapse theory is undoubtedly helped by the problems in the two biggest countries and the relatively strong performance of the previous pariahs, the so called PIIGS of Portugal, Ireland, Italy, Greece and Spain, but markets have a habit of reversing just when the story is most compelling. On balance, we see Globalism failing before the EU project does.

This is helping the US$ remain firm and pumping liquidity into US markets, helping the MAGA feeling among retail. Indeed, it feels like late 2021, when Bitcoin had also just doubled and there was a lot of ‘house money’ floating around. That bubble was burst from the discount rate side - risk premium for war and a higher Fed. This time around we suspect the earnings side may be where to look.

Asset Allocators may not play nicely

We see the biggest short term risks to markets as being over-confidence and false certainty in the retail space, together with a set of default institutional equity portfolios that may need to be sold in order to meet asset liability profiles. The concentration risk embedded in the M7 remains, as does the exaggerated Beta risk (around 1.4) that delivered excess returns in the top end of the US Market Cap weighted index in 2024.

With Bonds having done badly this year, they can once again ‘add value’ through being ‘uncorrelated’ which means that an unadjusted 60:40 fund now finding itself 67:33 thanks to 2024 performance is thus a seller of Equities into the New Year. With Asset allocators currently sitting on the sidelines reading year ahead notes that seem mainly to be catching up on last year’s low ball forecasts - and then extending them some more - we may find that it is the target date and asset liability funds that move first.

Medium Term Risk - Concentration and Beta

We made a point in our recent post about the Robotics and Automation ETFs that strong returns are often as important a time to check risk as weak returns. Too often, risk management is dismissed as a drag on returns, especially in the middle of a bull market. This is behavioural finance 101 of course and investors tend to lose the discipline to construct a portfolio to meet required returns rather than one to maximise returns while ignoring risk. Too often bulls try and predict the first quartile asset while bears try and predict the fourth. When the answer is to be in the quartile that delivers your best risk adjusted required returns.

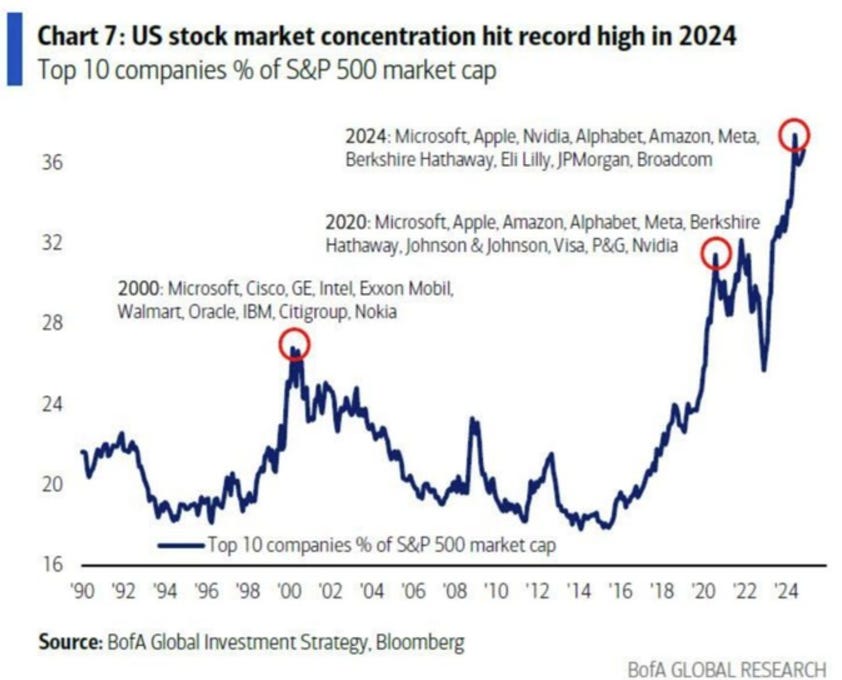

Probably the biggest medium term risk for investors is that already embedded in their portfolios - the fact that an original allocation to equities has now risen sharply with relative performance at the same time as the beta of the stocks held has gone up significantly - largely due to the Magnificent 7 effect. This is illustrated by the chart from BoA of the market concentration of the S&P500.

Followed by a second Chart of the beta of the top 10 holdings of BoA Private Clients, which makes a similar point.

In effect, investors are now crowded into the top quartile of last year’s returns, taking a large amount of implicit momentum, size and concentration risk. While looking only at benchmark and volatility and declaring risk (on those two measures) as ‘low’.

Nvidia has gone up in a straight line and now a major index constituent. Its low volatility and large market cap now means that there is less risk in holding it than there was a year ago. Apparently.

The concentration risk is not just limited to the US, in fact it is even worse in many of the smaller markets, especially Asia. Taiwan, one of the best performing markets this year is basically just TSMC.

The chart, from FSE Russell, makes the point that Global Tech has a number of subsectors and that within countries/regions not only do certain subsectors dominate, but individual stocks do as well.

Regions are dominated by sub sectors and subsectors by single stocks

Thus, we can see Emerging Market Technology is dominated by Semiconductors and Consumer Digital Services of which TSMC and Tencent are the dominant stocks respectively. Similarly, in Japan Production Technology is the most important sub-sector and is dominated by Tokyo Electron. For Europe it is also Production Technology (ASML) and Software (SAP).

By contrast, the US, with a wider range of sectors is almost diversified (!) and you can see the names of the five dominant stocks (Tesla and Amazon are not counted in tech). The risk is that, somewhat blinded by the returns, investors will think that their portfolio is diversified when it really isn’t and that even by having an apparently diversified sub sector of tech they are really just holding a concentrated stock portfolio.

Diversification

What to do? The answer is, of course, diversification, both within markets and between markets, while recognising that geographic diversification is probably diluted because of Global Index effects. In other words the correlation between markets may well be driven by the dominant single stocks, meaning that passive indexing is no longer reducing idiosyncratic stock risk, it is actually increasing it. While only focussing on market capitalisation.

This is why we believe in investing in Global Themes.

Long Term themes

The cold war over the currency continues to play out. In early October, we wondered if an announcement was imminent on a new BRICS currency to come as the Pre Election October Surprise. It turned out not to be. In November, we saw what might actually be the opposite - re-dollarisation rather than de-dollarisation as China issued some US$ bonds in Saudi Arabia, something that might be nothing, but might be as significant as China taking over the whole Euro $ market in the future - a wonderful twist on the phrase “Our currency, your problem”.

Meanwhile, the US continues to try and control other countries via its currency and banking system with a clear focus on ‘stopping BRICS’, just as they rallied to ‘stop Made in China 2025’ ten years ago. Trump’s threats on tariffs for those not using the US$ are ultimately self defeating, but it gives us an idea of the direction of policy. Interesting that China outlines plans for the economy, but says very little on foreign relations, while the US is very much the opposite.

Indeed, it looks like the US has a plan to break up BRICS and also to break up OPEC - Scott Bessent’s extra 3m barrels a day would make the US dominant (and also provide a buffer against any disruption in Iran). Meanwhile, should the Ukraine situation resolve itself, it may be that Russian gas will be allowed to flow to Europe again and even that NS2 is repaired while a long planned pipeline is built from Qatar to Europe via Saudi, Syria and possibly Turkey (It was Assad’s insistence on an alternative plan for Iranian gas via Iraq and Syria that allegedly prompted the civil war back in 2011).

This would be good for Europe obviously, but more important is going to be a pragmatic and sensible shift in policy with regards to The Green Leap Forward, which is the real reason why European energy costs are so crippling to consumers and uncompetitive for producers. Here again, we might take heart from the shift in emphasis away from Net Zero in the US, which will encourage European politicians to follow suit and push back against this core Globalist Policy.

Ties in nicely with the passive work by Mike Green. Ultimately it will be flows (linked to employment?), that determine if market concentration and the positive feedback look continues, or reverses.