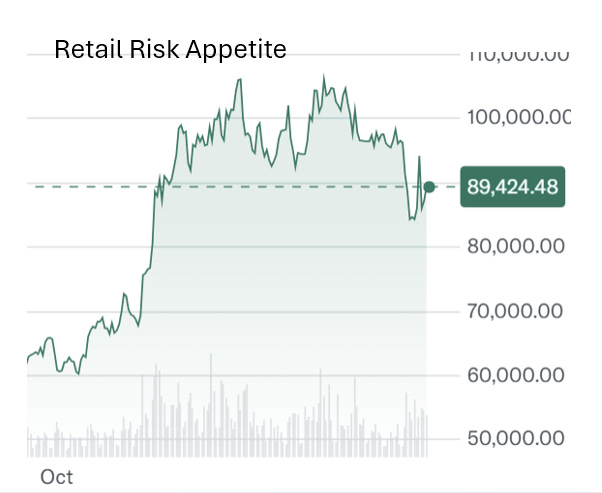

Bitcoin has its own ‘drivers’, but recently has been a great proxy for the Retail ‘Trump trade’ since last October and illustrates the recent downturn in risk appetite.

The arrival of Trump 2.0 pushed most asset allocators to the sidelines, waiting for some greater clarity on the difference between campaign rhetoric and reality. Traders and retail had no such qualms however, and aggressively chased ‘more of the same’ in meme stocks, themes stocks and Bitcoin. Indeed, we would regard Bitcoin as a good proxy for the MAGA trade euphoria - as shown in the chart.

January saw most allocators commit cash, but again into more of the same, albeit with the start of some diversification away from Mag 7, anticipating a bigger decision around the March options expiry (when we have observed over the years that the real allocations are made.)

Towards the end of February however, momentum stocks began to run out of, well, momentum, with high frequency traders and CTAs regularly flattening risk on a Friday in case anything radical came out over the weekend. Meanwhile a lot of the leveraged ETFs started to hurt and triggered margin calls and profit taking.

As a result, the I-Shares US Momentum ETF has begun to look a lot like Bitcoin.

As we recently discussed elsewhere (Welcome to MAGA-Vision) a lot of this perceived uncertainty is based on a belief that there is no coherent policy agenda behind Team Trump. We believe that there is a plan, but acknowledge that the market may be slow to accept this. As such, the risk is that asset allocators may remain on the sidelines once again in March, pushing out the reduction in risk premium into Q2.

To the extent they are allocating, we suspect some institutions will continue to add to Europe - which we would agree with albeit with caution - but also Japan, and, to the extent that they are ‘allowed to’, China. We would agree to both of these - and indeed in our model portfolios are already there.

Short Term Uncertainties - rapid policy change

The short term uncertainties remain heavily skewed towards Policy Change from Team Trump. February was a whirlwind first month with every one of the new team seemingly hitting the ground running leaving a dazzling (and dizzying) array of initiatives.

The first wave of initiatives were largely market neutral, with the potential exception of some tariffs, although they are not necessarily all they seem either (see Tweet loudly and carry a big stick ) and while the (over)reaction from those losing out - most obviously his political enemies - has been predictable, we need to quickly learn two key lessons.

First, Team Trump can not and will not be cowed by establishment opinion. The traditional Globalist media can shout all they want, but these policies are not going to be reversed - and that includes on economics. Second, that, like it or not, there is a plan and it will be enacted.

The policy is ‘back to normal’ and that includes normalising relations with Russia

The shift on Foreign Policy on Ukraine has inflamed Globalist sentiment, especially in the UK, which, as previously noted, is now almost ‘The Alamo’ of the movement, but the harsh reality is that Trump wants to normalise relations with Russia and that Ukraine and Europe are secondary to that.

We looked at this in more detail in Welcome to MAGA-Vision, but essentially the idea looks to be to pull Russia away from China and get access to the rare earths and minerals that the US can no longer get from its main economic rival China, thanks to tariffs.

One obvious example would be Tungsten - a key component in the defence industry as well as autos and other tech, but where 80% of the world’s production comes from China. And has just been blocked.

There is also the point that the real treasure in Ukraine, apart from the famous ‘Black Soil’ is the unconventional oil and gas reserves in the East. A joint venture to develop these, with US contractors rather than troops on the ground, looks to be the win-win deal Trump has in mind. US gets half the spoils in recompence, the other half goes to Ukraine reconstruction and Eastern Europe gets Ukraine gas flowing through the previously Russian owned pipelines. Or some variation of this.

The irony is that this would be good for Europe, but their Politicians are fighting it - for now.

Medium Term Risks - economic slowdown and popular unrest

We noted in our year ahead piece that Trump’s plan would be better for US Bonds than it would be for US Equities - as a focus on cutting the twin deficits would be more positive for bonds than the inflationary risk from tariffs.

By contrast, moves to break monopolies and make for more consumer friendly regulation risk earnings for the mega cap stocks which distort the Stock Market as a representation of the wider economy. To this we can obviously now add the Deepseek ‘shock’ which is re-evaluating notions of economic ‘moats’ in US tech stocks.

With the markets no longer driven by QE and discount rates, earnings and Geography will become important again

We think that as clarity emerges over Team Trump’s plan - essentially to treat the US as a company in need of restructuring - that risk premia can compress again. However, we see the trend away from momentum and memes continuing with more of a focus on diversification by sector, theme and geography.

The likely outcomes are policies that are broadly pro US Treasuries, with less concern for equities. At the moment, 10 year yields are operating in a band between 4% and 4.6%, having briefly moved out of either end, but more importantly the yield curve for both 5yr and 10 yr Treasuries has once again inverted.

This is partly in response to concerns over the economy - again in part driven by (sometimes partisan) views about Team Trump economic policy - but likely also reflecting a view that addressing the Budget is a serious priority.

European Policies NOT good for bonds

A bigger concern remains Europe, where the recent German Elections highlighted the rift between the rulers and the ruled. The clear shift away from Globalist centre policies on open borders, draconian Climate Policies and ongoing war in Ukraine has been essentially ignored by the political establishment, who are looking to put together a coalition promising more of the same.

By refusing to acknowledge the anti Globalist messages from the public, the political class risk escalating populist tensions

The CDU won on a protest vote, but by refusing any role for AfD, the establishment is effectively disenfranchising the former East Germany, where they now hold the majority of seats (as well as coming a close second in many working class parts of former West Germany.)

The map (from this detailed analysis of the situation) makes this very clear.

As with unstable coalitions in France - also designed to keep out anti Globalists the ‘far right’, the nullification of Elections in Romania and the persecution of populist opposition leaders in Georgia and elsewhere, this is very de-stabilising.

The medium concern for markets is, that in order to change the rules around its so- called debt brake, that had led to the election in the first place, Germany needs a two thirds majority and, without the ‘excluded’ parties, it won’t get it.

Thus while the politicians are focussed on US Foreign Policy, seeking to create some form of Eu solidarity, markets are starting to focus on the weak economy (due largely to Globalist policies) and will start to worry about a rerun of the Eurozone financial crisis.

The chart shows the German Yield curve and the contrast of the current position (heavy grey blue) over the last month (green dotted) let alone 6 months (red dotted).

In the near term, European equities are benefitting from Geographic rotation generally and also a ‘Meme Theme’ of defence stocks, but this is one to watch closely.

Meanwhile China - flipped from selling rallies to buying dips

As we also noted at the start of the year, our biggest difference from most consensus has been on China, where we have been notably more constructive on the economics, while acknowledging that international investors had been selling the rallies. We saw that as finished by the end of last year - the sharp spike in late September was short covering. But now, investors are buying the dips and stocks like our long term favourite Xiaomi are storming ahead.

The Deepseek effect is obvious here, as much for the fact that it has pierced the veil of propaganda that China could only imitate rather than innovate.

Meanwhile, the ‘all news is bad news’ western media continue to tie themselves in knots over China. This below from Bloomberg ‘Most Read’, reported on Yahoo finance.

In January, the ultra low yields were not portrayed as being the result of one of the best performing bond markets in the world last year, rather as ‘proof’ that China was headed for recession and thus needed a western style rate cut (always the recipe proposed).

Now, as they sell off, rather than ‘proof’ that the economy is growing in line with target of 5%, we are only told about ‘their worst slide this year’. Damned if you do….

Long Term Themes - some big changes

As discussed in Eternal and Perpetual, Scott Besant and team are looking at some dramatic options on the US deficit, something being referred to as the Mar A Lago accord, including an idea that Sovereign holders of US Treasuries may find themselves offered military protection or a ‘normal’ yield on their bonds. But not both. This would benefit the budget by cutting interest costs as well as stabilising the US Treasury market more generally.

Meanwhile, the notion of a US Sovereign Wealth Fund is also interesting - perhaps by revaluing gold assets and borrowing the $750bn from the Fed. This would allow actual ‘investment’ in infrastructure, rather than Government spending with all the limitations and pork barrel issues. One idea would be for the USSWF to be a co GP in projects managed by the giant PE funds - also used as a sweetener to a policy to tax carried interest as income. Income from taxing foreigners (via tariffs) might also be hypothecated into the SWF and there may even be a plan for a GIC/Tamasek style setup to ultimately involve a form of MPF.

What is clear is that Team Trump are not only thinking radically but are copying China, in looking around to copy good ideas when they see them and avoid copying bad ones.

More broadly, we see this as a new era designed to focus on fixing the deficit(s) not simply on keeping the funds flowing to the equity markets.

The need to be dynamic

We think that the dominance of passive index investing for institutions has got to the stage where is is opening up opportunities for active managers - not to compete with the passives, but in the absolute return space. ETFs, especially thematic ETFs, have grown so rapidly in the last 5 years that asset allocators can considerably reduce their stock specific risk while still being alert to fundamental trends on the basis that “there is always a bull/bear market going on somewhere”.

Putting together a portfolio of thematic ETFs in the manner that we used to put together a portfolio of stocks is thus very much the direction of travel in our opinion. (full disclosure, this is exactly what we are doing ourselves in our collaboration with Toscafund HK)